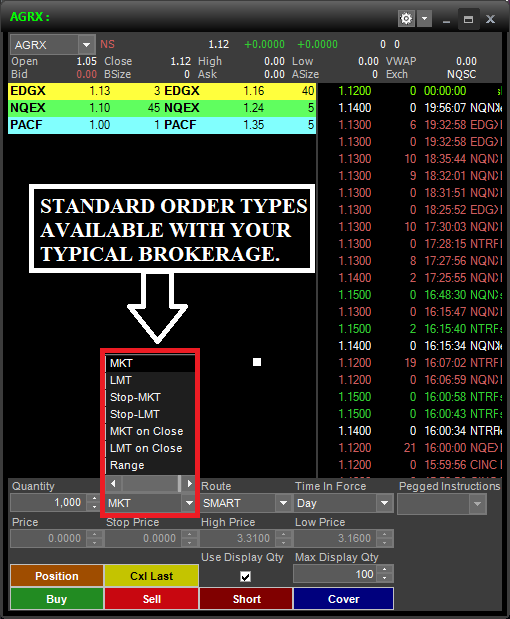

Learn what order types to use when trading stocks. Understanding the meaning of each order type is an important aspect to day trading and investing. In this blog post we will go through the standard order types most brokerages offer, what they mean, and explain when and how you should use them.

All order types available with most retail brokers: MARKET. LIMIT. STOP-MARKET. STOP-LIMIT. MARKET ON CLOSE. LIMIT ON CLOSE. RANGE

Market Order

An order sent by the trader/investor that is the fastest and easiest to fill. When buying at market, the trader will be taking liquidity from the market, filling immediately at the best available price.

With a market order you will be guaranteed a fill but a specific price is not guaranteed. Therefore, keep in mind the risks of using market orders on highly illiquid or thinly trading stocks as the slippage you will get from using a market order may skew your risk reward profile.

Market Order

Limit Order

An order in which the trader specifies a price where he/she would like to be filled at or better.

This is the most common order type used as it is the safest and gives you full control over the price you may get filled at (the limit)

Lets look at a few examples of how these orders can be used:

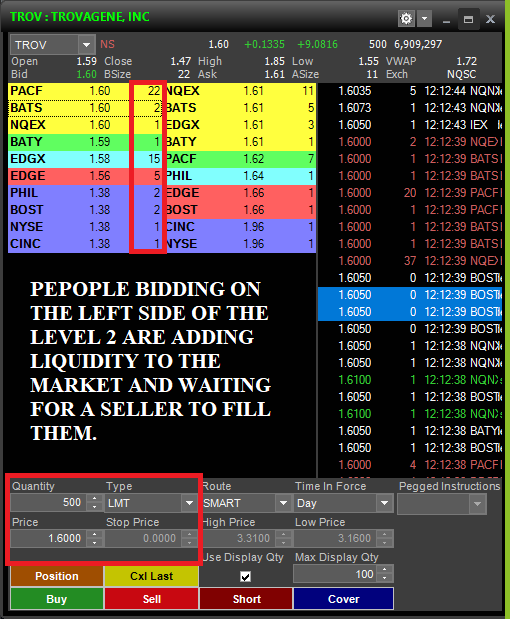

Adding Liquidity

Adding liquidity with a limit order can get you a rebate credit from your broker with certain ECNs (ARCA or EDGEX for example), or in some cases, (like with our preferred broker Trade Zero) they won't charge a commission if you are adding liquidity to the market.

In this example, if I am bidding 500 shares of TROV at $1.60 I am adding liquidity to the market and will have to wait for someone to sell their shares to me before I get filled.

Left side of the level 2 = bidders adding liquidity. Right side of the level 2 = sellers and short/sellers adding liquidity. Time and sales (far right) are the transactions happening in the market. The $1.60 red print at 12:12:39 on the time and sales is a person removing liquidity from the bid (he's either selling 2000 shares or shorting 2000 shares to the person who was adding the liquidity to the bid at $1.60.

To add liquidity with a limit order to buy a stock, you are simply placing a limit order at or below the bid price and waiting for a seller to fill your order.

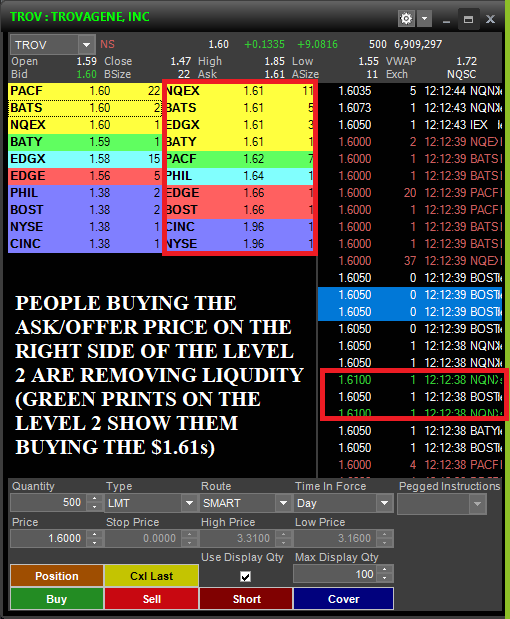

Removing Liquidity

This is the fastest and safest way to enter or exit a stock immediately without the risk of getting a bad price.

To enter the stock immediately you have the option to use a limit order at or above the ASK/OFFER price - This will remove liquidity from the ASK/OFFER and get you in the trade right away.

The reason we prefer using LIMIT orders over MARKET, is because with a limit order you can specify the worst price you are wanting to get filled at.

For example: If I wanted to buy 1000 shares of TROV at $1.61 but pay no more than $1.63 for the shares, I could send a limit order at $1.63 and that will immediately execute by removing the ask/offer price at $1.61 getting as many shares as it can to fill my entire order without going above my $1.63 limit.

This is a safety net to ensure you don't get filled at a bad price.

For more information on the different between adding or removing liquidity on the market, please view this post.

The people buying (green prints) from the ask/offer side can also be shorts covering their positions at the ask/offer. at 12:12:38 someone bought 100 shares from the ask/offer at $1.61 (this person was removing liquidity from the market). The person who had the shares up for sale at $1.61 was adding liquidity to the market. Get it? 😀

Stop Market Order

This order type is essentially a market order that will only be sent when a stock reaches the specified order price.

Using a Stop Market To Enter a Position

If a trader would like to buy 1000 shares once the price of a stock hits $1.00 per share, they could use a STOP-MARKET order with a price at 1.00 and press the "BUY" button to send that order.

It will remain in your order log (until cancelled or executed). Once the price of the stock hits $1.00 it will automatically buy 1000 shares at the market (ask price of $1.00 or higher).

Using a Stop Market to Exit a Position

If a trader is long a stock at $1.00 per share and wanted to automatically exit the position if the stock price reached $0.99 per share, they may use a STOP-MARKET order with the price specified as $0.99 and use the "SELL" button to send the order. The order will remain in your order log until cancelled or filled.

If the stock price reaches $0.99 it will automatically trigger a sell of 1000 shares at market (current bid price and lower).

Stop Limit Orders

A stop limit order is an order that is sent to the market only once the stop price is reached, and wont execute any lower than your set "limit" price.

Stop Limit Order Example:

Take for example the previous scenario that a trader wants to buy 1000 shares if there is a $1.00 breakout and gets his shares filled. He can use a "STOP LIMIT" order with a stop price of $1.01 to automatically trigger a buy once that price is reached, but the "LIMIT" price (bottom left of the level 2) at $1.03 specifies the highest price he is willing to get filled is $1.03.

You will not get any shares filled higher than $1.03 in this case as that is your "limit".

This order type will trigger a limit buy once the stock price reaches $1.01 and won't fill any higher than the limit price of $1.03

Range Order (Bracket Order)

This is a very handy order which is extremely useful in trade management.

Lets say, for example, you are in a short position from $9.90 and your plan is to stop out if it hits $10.00 or take profit at $9.50.

This order type will allow you to send out both a profit order and a stop order at the same time, whichever one fills first will cancel the other.

Range Order Example:

In this case (see picture below), your high price is $10.00 and your low price is $9.50, you would then click “Cover” and your order will be sent as a Buy/Cover Stop for $10.00

and as $9.50 buy/cover limit order.

This type of order is excellent for those who micro manage their trades watching every tick, or for someone who can’t be at their desk the whole time and just want to leave the position to let the market do its thing. Either way, it’s a sure-fire way to make sure you stick to the plan you’ve set and have your orders out way ahead of time to reduce the need for reaction speed to stop out or cover in a split second.

This RANGE order type will automatically stop out the short position at market if the price reaches $10.00 or higher (high price) and will automatically close the position for profit if the price reaches $9.50 (low price). In this example, its for a short position so you would press the SHORT button to send the order. If it were a long position, you would make the "high price" the profit target and the "low price" the stop market order and press the "SELL" key to send the order.

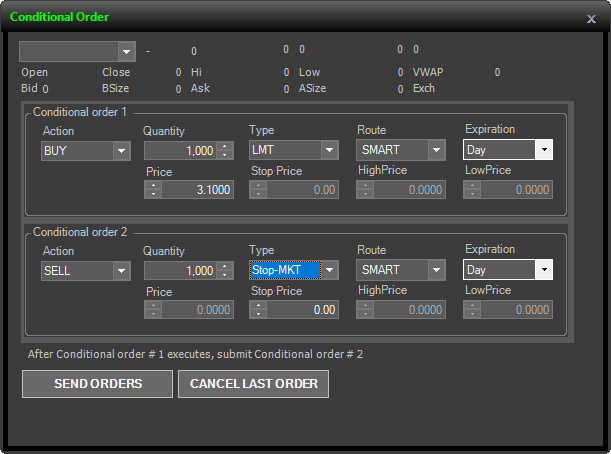

Conditional Orders

A conditional order is similar to a range order but its system is executing Order A then Order B.

Conditional Order Example:

The way it works is, a trader will fill out two orders. The orders must be filled out in the sequence they would like it to be executed. For example, a trader wants to buy a stock at $3.10, with their stop at $3.00, instead of putting out the orders separately one at a time, they can fill out a conditional order that states to buy 100 shares of $XYZ at 3.10 (a limit order), and if that

order fills then send an order with my stop (stop market) at $3.00.

This is useful if you’re entering a very fast-moving stock and don’t want to spend time typing out your stop order after you’ve entered, you can do it all in one step. In addition, it can be set up in various ways, the second order can be a range order like we discussed previously, or a just a take profit order if you’re expecting a fast move and want to have the order out ahead of time. This is another type of order that not all brokers will have, but once again Trade Zero offers them, and it can be found in the Zero Pro platform in the main menu bar (see pictures below for guidance).

Conditional Order - If order #1 executes (buy 1000 shares at $3.10) then order #2 to STOP MARKET 1000 shares will automatically send at specified price under the "stop price" field.

In Conclusion

With all these different types of orders, it can be seen that each kind of order suits a different purpose, and each type of order has their pros and cons.

You must find and use not only the right types of orders to fit your trading methodology but also orders that can aid you in your trade management.

A good example would be using conditional orders to get your profit targets out ahead of time once triggered in, or using range orders to avoid micromanaging

positions. Whatever the case may be, be creative and experiment to find what will best support you in your trades.

At Livestream Trading we walk our traders through our setups and trade plans step-by-step, giving the exact entry points with defined risk and profit targets so they can be best prepared

for how they want to enter and handle the trade.

Until next time, trade safe!

learn How To DayTrade Stocks

Get Started with a Free Day Trading Video Lesson Below!