As traders and investors its important to be familiar with the common scheme known as the pump and dump. By definition, a pump and dump scheme encourages traders and investors to buy shares in a company to inflate the price, and then selling their own shares when the price is high. Here's what you need to know:

What is a pump and dump?

A pump and dump is the act of a person(s) issuing buy alerts on thinly traded small cap stocks forcing their followers chase the price up so the owner can then dump their shares into the hands of their followers.

Even worse, the owner will often buy his shares before he issues the alert, in order to sell those shares into the hands of their subscribers as they chase the price up.

This way the owner can make a win from the artificial "pump" in price, leaving their subs holding the bag for big losses. If you are constantly chasing chat room alerts by using market orders to buy low volume, thinly traded stocks, the results can be disastrous.

When a stock is doing close to no volume and has a small float, it has the potential to be manipulated easily by a flurry of buyers. The problem is that there are no real buyers in the stock, so it finds no support on the pullback and the artificial inflation in price rapidly declines back to where it came from as everyone scrambles to exit the trade, leaving the vast majority of people stuck for a big loss.

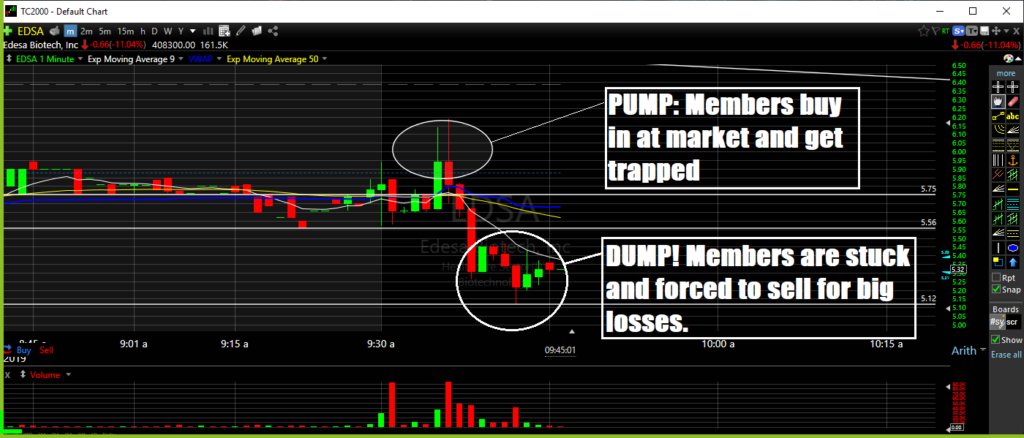

$EDSA Pump and Dump Example

Professional trading groups do not “Pump and Dump”

Imagine you were the person buying $6.50 on this chart less than 1 minute after an alert and selling it minutes later for a huge loss of over $1.00 per share... ouch!!

Some owners will even boast about their profits after the trade on social media (twitter, Instagram, etc), knowing that the majority of their "team" lost on it, in order to attract new people to the group, to help fuel the next pump and dump... the audacity!!

Creating hype and chasing a stock is not the way a professional trading group should operate!

Trading strategies should be discussed in advance

All ideas and trades should be explained ahead of time, giving people clear and defined risk levels to play from, giving the group members time to understand the plan, and time decide if they want to participate, and most importantly, plan the risk on their trade.

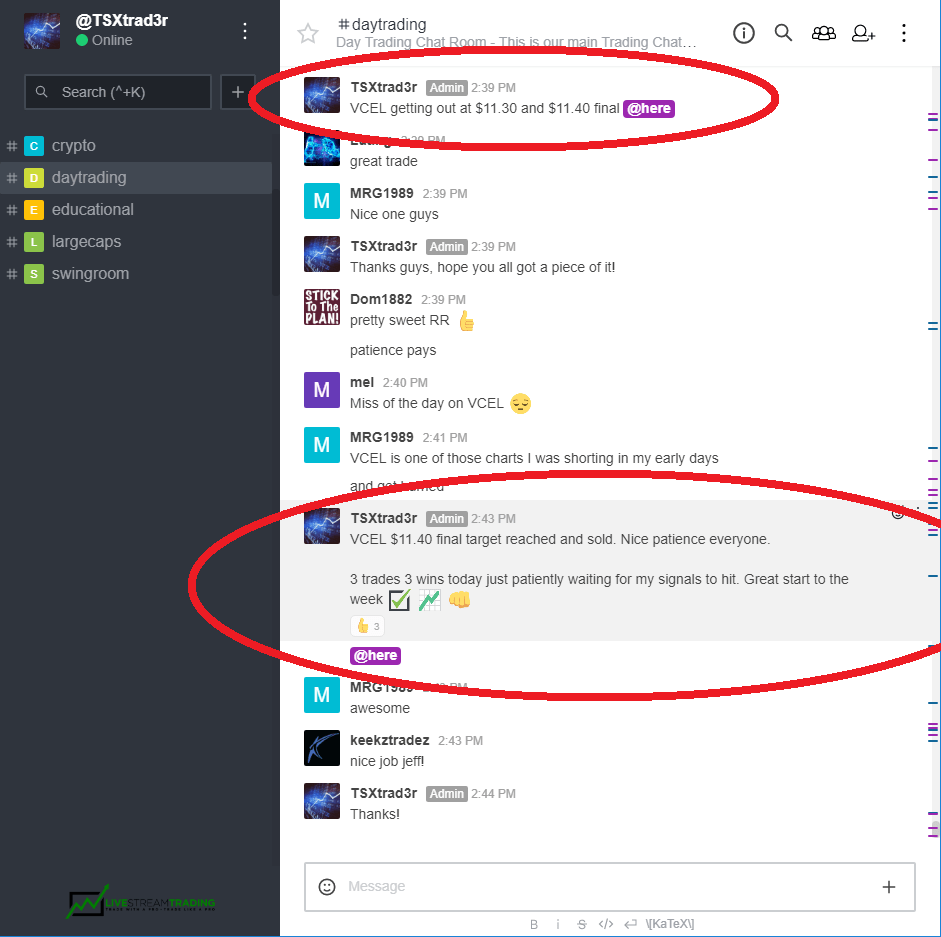

No-Pump Trade Example 1:

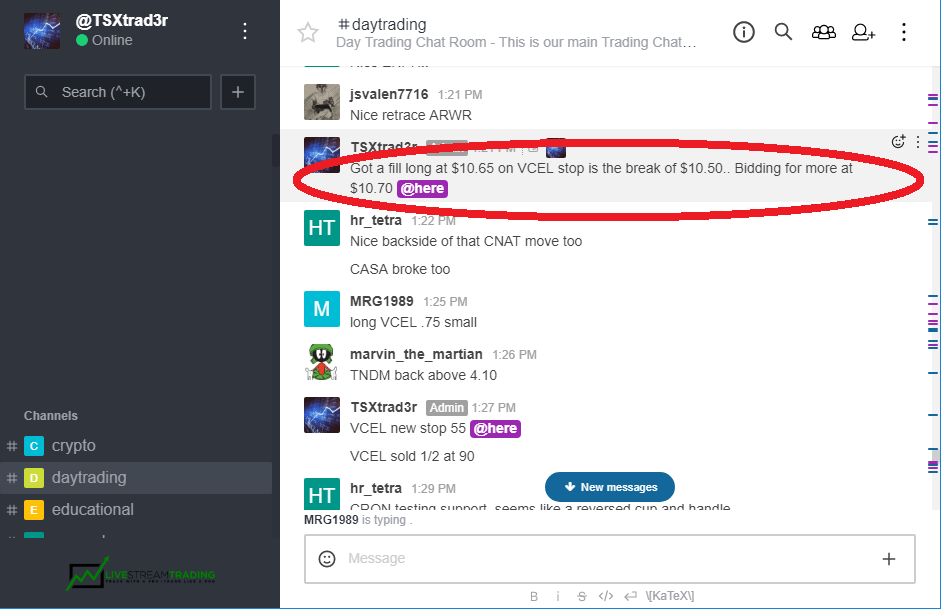

Here is an example of a real trade, on a real stock, doing real volume, where we identified and executed a live trade VCEL on the afternoon of March 5th, 2018.

This setup gave us a clear defined risk level. The stock was doing over 8 million shares of volume, there was no way that a buy alert could move the stock, and there was over 10 minutes of trading between $10.65 - $10.80 after our alert allowing people to think about the decision they are making, and plan their trade accordingly.

The stock steadily climbed up to a high of $12.00 per share that afternoon. A liquid stock like this allows us to enter and exit trades at the prices we want without slippage, and the volume means there are plenty of buyers and sellers participating in the trade to create the "market" we need to easily buy and sell our positions at the prices we want.

Plan for the stop

As seen in the image above, after explaining on the live stream that we had a confirmed risk level at $10.50 in an active stock with volume and potential to run, we entered the trade with a clearly defined risk of 15-20 cents per share MAX.

This is absolutely crucial in trading, to plan for the stop, so you know what you are risking, and manage your trade accordingly.

VCEL Long Chat Alert

Warning signs of a pump and dump

- Moderator doesn't mention risk or stop loss levels. He/she hypes the stock (talks in a very excitable manner), creating the anxiety of fomo (fear of missing out on the trade), and subconsciously leading people into chasing a stock that doesn't have good risk vs reward potential.

- Moderator actually encourages using market orders to buy the ask/offer side, as opposed to giving members the opportunity to join the trade before a breakout (chasing).

- Quite often the stocks traded only have one quick pop in action (the pump as the group chases the stock up), and then immediately turn around and sell off (the dump after the mod sells and members are scrambling to exit).

- Moderator never gives ideas ahead of time, is always keeping people waiting to smash the offer so they can try to get ahead of the crowd.

- Moderator often boasts profits on social media, and in email threads to their subscribers, as opposed to focusing on whats important, the actual trading and planning of trades, and working with their members to develop a working trading system.

- Moderator rents Lamborghini's or other super-cars for Instagram motivational posts to get people excited about the "get rich quick" day trading lifestyle.

- Moderator offers free trials (this is especially common in pump and dump groups) - The more people they have in the chat to buy the stock, the better the pumps work.

Remember: No professional trader who has a working trading system is going to give it away for free.

No-Pump Trading Examples

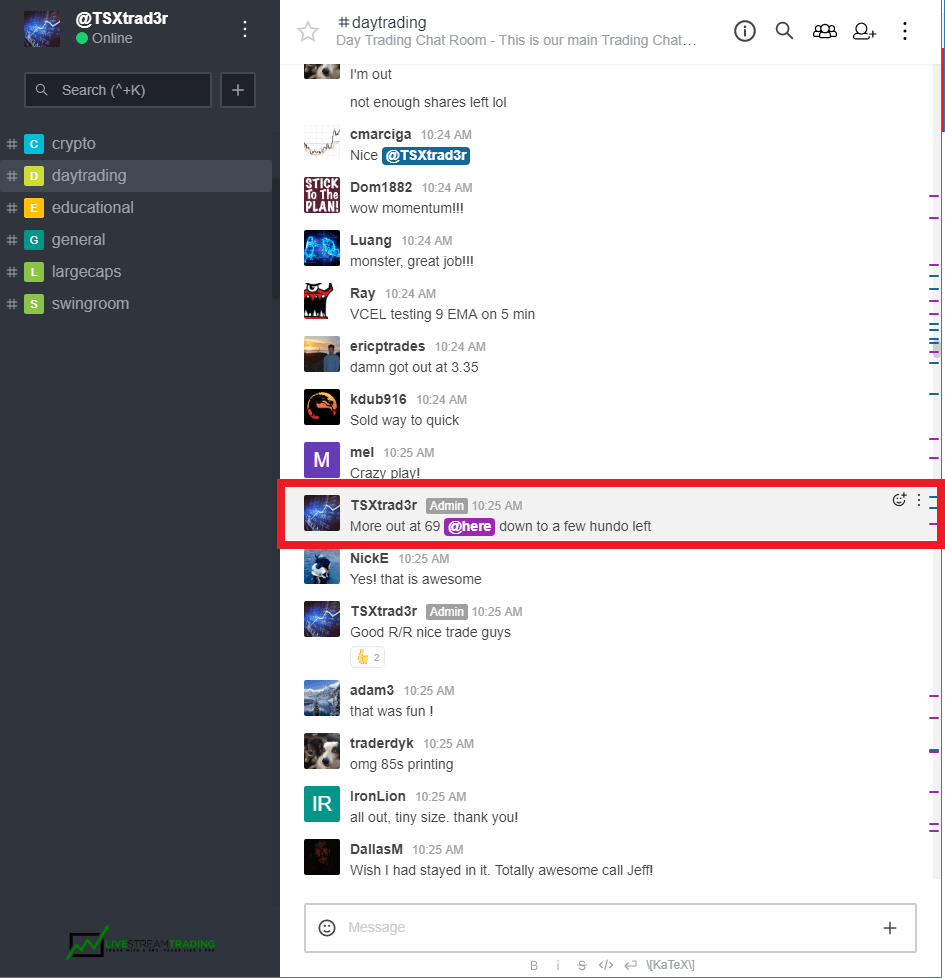

The stock in question on March 7th, 2018 was PIXY which hit our pre-market scanner (live pre-market trade ideas scan streaming every morning for our group at 8:30am EST).

Each morning I have at least 5-10 stocks that I'm watching with a tentative plan, but I will only trade the BEST 1-2 setups that match my trading system each morning.

These trades must yield a high probability of return on a low risk setup and a tight stop that will give our team a chance to enter the trade BEFORE the herd, as these setups give the best return and the lowest amount of risk.

Please see the image below explaining our buy point on PIXY (and see the time stamp vs the chart)

PIXY Trade

Analyzing Risks

After explaining on the live stream that we had a confirmed risk level at $3.00 per share (10-15 cents away from our entry point), and a setup with high probability of a big reward, we entered the trade on the bid beginning at 10:06am (see above image and time stamp in chat).

We do not encourage chasing stocks, our team knows to enter on the bid or at a max limit price that they are willing to risk from the stop point. Even though this was a lower float stock, the stock had 15 minutes of consolation in that area where our traders have time to think about what they are doing and plan their trade before it broke out to highs.

This gives our traders a chance to assess the plan, plan the risk, and decide if they like the idea enough to trade it with us, and have a great chance of yielding a good return on their trade with very minimal risk.

Managing your trade

This is absolutely crucial in trading, to plan for the stop, so you know what you are risking, and manage your trade accordingly.

If you bought just 1000 shares on the pullback at $3.15 you would have been risking $150 on the trade, and the best price reached on that move alone was over $3.90 which could have yielded a reward of nearly $800!!

The stock is ended up trading over $4.30 in after hours that evening.

Trade with professionals

The fact of the matter is that professionals are selling over high of day, not buying. We strongly discourage chasing stocks, and we despise the "pump and dump".

If you are serious about learning to day trade from a professional group, we would love to work with you. Our chat room and live stream is a great place to learn how to identify and trade low risk setups that have a high probability of return with detailed trades, live explanations, and a friendly small community of helpful traders and moderators.

Despite the market being a bit slow in February, our win rate was 79.5% on livestreamed trades, and we feel that this month as the market picks up we should be seeing much bigger moves on these trade setups!

The conclusion

I hope this blog post helps you understand the value of risk vs reward, and being ahead of the herd with a team of professional traders who have your best interest in mind.

If we get the pleasure of working with you, please be sure to watch the 15 main video lessons in our FREE course for members when you log in for the first time to learn our risk management / trading system, and dive into our daily trade recap webinars for detailed explanations on all of our trades designed to accelerate your learning curve as quickly as possible!

Please share this to make the day trading community a better place!

Until next time, trade safe and trade smart!

P.S. - Grab our free day trading video lesson below!