Are you gambling in the stock market or playing with a defined edge? The time is NOW to stop guessing and start trading with clarity, discipline, and confidence. Tilt the odds in your favor with a systematic trading approach.

Systematic trading means using a specific set of pre-defined rules and criteria to validate trades which completely eliminates guesswork, emotion, and discretion from trading.

This means that every trade you take will have criteria (chart pattern, entry point, defined risk levels, and many other factors) that are statistically proven to be profitable.

Lets revisit that phrase "statistically proven to be profitable".

This means you have vigorously tracked, back-tested, and traded this setup hundreds or thousands of times in all different types of market conditions, and the results prove that it is a valid and repeatable trade that works a large percentage of the time, thus giving you a statistical edge against the market.

Building a Working Trading System

Sounds like a lot of work, right? No kidding, it is! I've been trading for over 12 years and it took me most of those years to fully develop a bulletproof trading system.

It would have saved me years of struggle if I knew how powerful journaling and tracking data was from the beginning.

I did things the hard way, but you don't have to!

The benefits of Systematic Trading

When you using a systematic trading approach, you give yourself a statistical edge in the market which makes trading much more enjoyable, less stressful, and most importantly, more profitable.

I've been trading the markets for over 12 years now. I've been though a heap of different strategies and approaches. I've worked with 1000's of traders from my prop trading days to my student traders at LiveStream Trading, and I have helped people through all the common pitfalls and struggles we face each and every day as traders.

The cure to almost ALL of those problems boils down to having a complete working trading system in your favor.

Once you know exactly what to look for, trading becomes very quantifiable and clear. You know exactly what you need to see in order to execute a trade.

If you see a setup that matches all of your criteria, you can put on a trade with risk and be confident that the outcome will be in your favor a large percentage of the time.

Its like being at the casino but instead of being the player, you are the house!

How our System Works

We have a 4 point system of criteria that we need to enter a trade, and if all the criteria is met then we can trigger our trade with confidence knowing that we have a statistical edge in these trades and they will work out with one of only 3 possible outcomes:

1. Small Win - The trigger point offers 1 or 2 profit targets but lacks follow through, stop the rest near break-even for a small win.

PRPO One Target Trade

2. Big Win - The trigger point offers 1 or 2 profit targets, move stop to break-even, and ride the trend with zero risk to final targets.

Big win example on MARA - 10 cent per share risk trade, all targets reached.

3. Small Loss - The trigger point fails and no profit targets were reached. You take your planned stop which is a controlled loss and planned in advance.

Planned / Controlled Loss Example

Taking Stops

Taking a stop is not a bad thing! With every trading system, no matter how good, there will be a sample of losing trades.

If your trading system offers an 80% win rate, for example, then 20/100 trades will be losses!

The sooner you realize this, and plan for those losses (using tight risk entries, planned stops, and always honoring your stop loss), the better your performance will be, period.

This is absolutely key.

Risk Management

A good trading system requires a good risk management system. One winning trade setup that gives you a 75% statistical proven edge to win should wipe out 2 small losses.

Notice how there is no 4th outcome "Big Losses". Why is that?

Well, because we don't take discretionary trades. We don't guess tops or bottoms, we don't chase stocks or alerts, and every trade that we take is timed by our system to offer the lowest risk entry with the highest probability of return.

We know that if we trade our system we will win, and if we stray from it or don't follow it, we will lose. Its as simple as that. You should be in the drivers seat when you are trading, not riding a rollercoaster holding the "holy shit" handles.

Ultimately, as long as we follow our system, those are the only 3 outcomes that are possible, which really helps with our students confidence and allows them to find comfort in our system (especially while watching me trade it live during the day and walking thru the trades step-by-step).

How to Develop Your Trading System

OK, so you know what a trading system is, and you are sick and tired of guessing where stocks are going, taking boredom trades, trying to top tick or bottom tick stocks, and you want to start making better trading decisions and having more direction and less emotions in your trading. Good!

The easiest way to get started of course would be to start with a foundation of someone else's trading system and then tweak it slightly to fit your trading and personality type.

You can learn my trading system step-by-step via the video lessons and course included with registration to our group, and you can watch me trade it live every day with step-by-step instruction and guidance which is the fastest way to learn, but if you aren't ready to join our trading group, read on! Ill help you get started in this post.

The First Step is Journaling Your Trades

Every professional trader I know keeps a trading journal. If you've been "winging" it all this time and you are ready to step up to the next level, then you are willing to take the 1-2 minutes it takes to screen shot your chart after a trade and save it so you can analyze your trades after the fact.

If you want to use the same trading journal as me, please see our blog post on journaling!

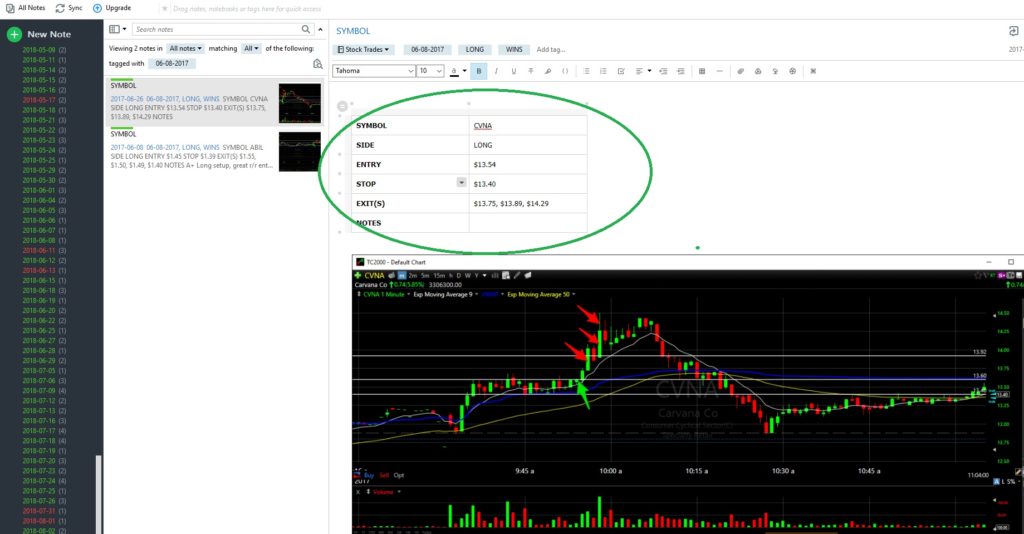

Take a screen shot (like the ones above) of every trade that you take. These screen shots are going to give you visual representation of the trades you took with the entry points, stop loss, and exits.

Be sure to include notes in your journal so you know where the stop loss was VS the entry point, and what the setup was that you were playing.

Fast forward a few weeks, you've taken 50 trades and now you have some data to work with. Go through the journal entries and categorize each trade by the setup. For example, "Long flag break pattern" or "Short Setup" - Keep all of those trades together, both wins and losses; now here's where the fun begins.

Analyze the Results

First look at all the chart screen shots of the trades that are winning, and focus on those. Ask yourself these questions:

Which setup was it that yielded the best results?

What time of day was it when you took the trade?

Was the stock doing above average volume? Was the stock up on the day or down on the day?

Was the stock over or under key support/resistance areas?

Was the stock in an uptrend or downtrend?

So on and so forth.. I look at everything.

Now look at the losing trades:

Were they boredom trades?

Was there a valid "setup"?

Were you going long into a down-trending stock?

Were you chasing an overextended up-trending stock?

Were you buying into resistance?

Ask yourself all of those questions (and more) and particularly focus on studying the losing trades so you know where you are going wrong. Chances are, there are some correlations in the losing trades that you may be repeatedly taking that are easy to avoid as long as you know you are taking them!

Remember, you cant fix what you don't know, and you can't improve what you don't measure.

For example, trying to short into momentum. This is a losers game, and can result in massive losses. We have a system for shorting that offers a very low risk entry point and a planned stop, that gives an 80% chance of success, and if it stops me out, the loss is relatively small vs the reward that this setup typically offers.

How do I know this? Because I've taken the trade 1000s of times and tracked the results in my journal!

Using a Trading Journal to Track Results

The problem with not journaling is that you don't take accountability for your actions. If you look at that trading journal every day and look through your past trades, you will see the correlations on the winners (and especially the losers), and it will help instill good habits into your trading, and naturally, you will focus harder on avoiding the trades that your journal has proven DON'T work for you, and then you can hone in on perfecting the trades and setups that DO work for you!

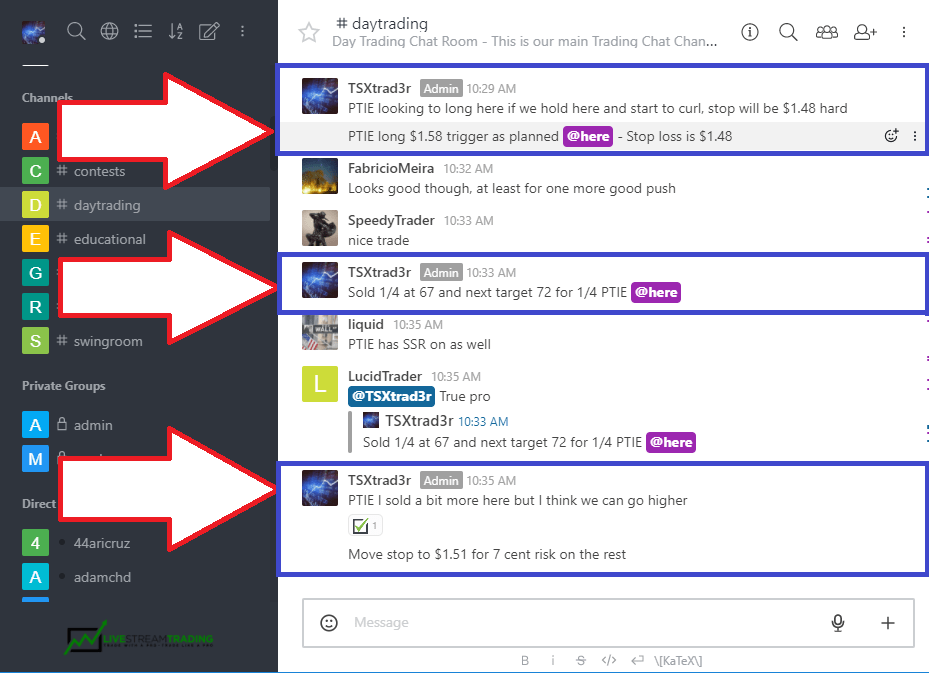

So, lets take a look at some recent trades. We had 2 valid setup triggers. The first was a short on $STAF which resulted in a win of 40 cents per share, and the second was a long on $PTIE which offered just under 80 cents of upside from our trigger point to get long with a stop just 10 cents away from the entry.

Both trades reached all 4 of our profit targets, and both trades offer a very low risk entry point vs the stop.

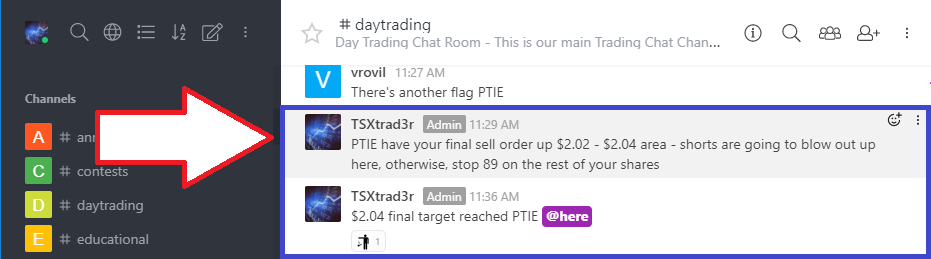

Lets take a look at PTIE. Here are the chat logs and chart:

The Right Trading Strategy

So, as you can see we had a clearly defined entry point (which was explained ahead of time on the screen share with live audio and posted in the chat room) and an exact stop loss point 10 cents below the entry. This setup is what we call a "trigger" point which is where all of our criteria lined up to enter the trade with confidence, knowing only 1 of the 3 possible outcomes we discussed above could happen, with a strong favor in the win category.

In fact, this trade setup tends to have a 75%+ win rate, so we play it often. We explain in detail the exact criteria that needs to be met in our video lesson library which outlines our entire trading system with hundreds of examples of live trades in our daily webinar for our traders to watch and learn from. These are all instantly accessible with a mere 1 month access to our trading group.

The entry triggered at $1.58 and the risk was just 10 cents per share. To put this into perspective, if you bought a measly 1000 shares of this stock risking just $100 on the trade, you could have sold near the peak of this move for over a $700 profit!

Now, realistically, you are not going to hold for that entire move, we take profits along the way, move our stops up to guarantee a win, and trail 1/3 or 1/4 of our position until we get a "sell signal" ... but you get the idea!

Using a Trading System

As you can see, there was an exact point defined where we would sell the stock at $1.89 if the move did not continue higher, so we can lock in profits and get out before the herd starts to sell. In this case, the stop didn't trigger, so our final targets over $2.00 per share were hit for a very nice win.

Now, this is a great example, but of course, not all trades are this easy. There are times where we will only get a profit target or two and then have to take a breakeven on the rest of our shares for a small win, and of course there are times where our stop is reached for a small loss, but no matter what the trade, we know exactly the entry point, risk level, targets, and based on our system we have a 75%+ expectancy of the trade working in our favor (as long as all 4 points of criteria are met).

The point is, when you have criteria and patterns that are repeatable and "systematic", it takes the guess work and emotion out of trading completely, and allows you to simply follow a process that you do over and over again each day.

If you don't currently have a trading system or strategy, you need to develop one! Track the results religiously so you can tweak and refine your strategy until its perfect.

Make one that works for you as an individual. It may takes years of back-testing and hard work, but its worth it when you have something that works for you. It took me nearly 12 years to develop and perfect mine, but an even easier way to go is to simply learn an trading system from someone with years of experience, and then tweak it to your liking / style.

In Conclusion

I want to personally thank each and every one of you for being a reader of our blog and subscriber of our YouTube channel. If you are serious about learning a systematic approach to the market in a very professional environment, join our team and get access to our step-by-step trading system (videos included free with any membership level), all-day live stream (with live trade explanations and walk-thrus), 24/7 chat room, daily training/recap webinars, 400+ video lessons/webinars/trade recaps and much, much more!

Hope to see you guys on the LiveStream soon, I'm looking forward to helping you and many others reach your trading goals!

P.S. - Grab our free Day Trading Video Lesson below!