There's no question that the market dynamic has changed significantly since the global pandemic.

Stimulus checks, time off work, and more free time than ever for the general population has exploded the popularity of day trading. But what it for better or worse?

In this article I'm going to outline how the pandemic has changed the market, how it particularly affected my trading, and most importantly, what you can do to get on the right track with your trading if you are having trouble adjusting to the current market environment.

How the Pandemic Has Changed the Market

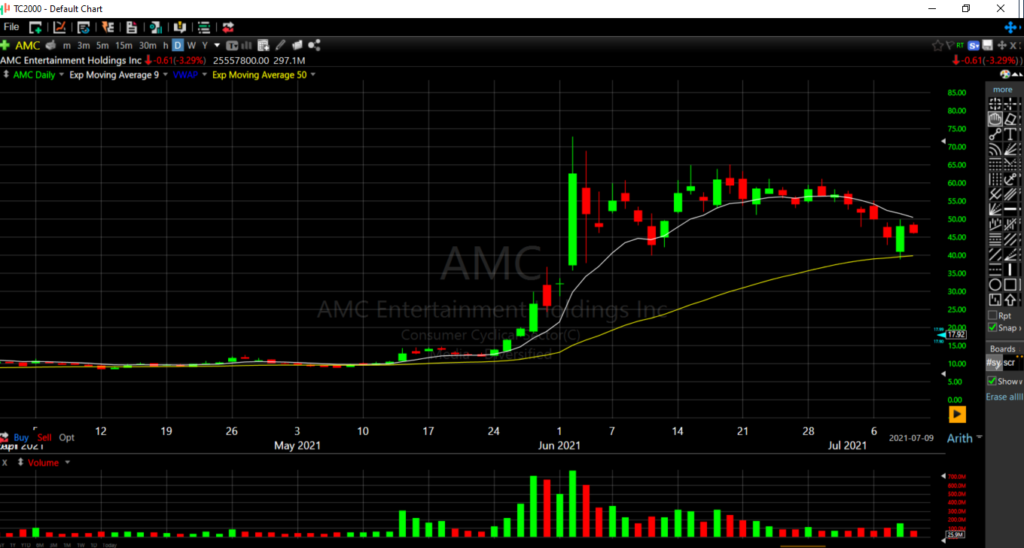

In the wake of the pandemic, it dramatically shifted the way the stock market normally behaved on a day to day basis. This shift likely disrupted some experienced traders who were used to more predictable moves in the market, and even some hedge funds (*cough* AMC and GME short squeezes) have taken devastating losses at the expense of retail traders (for once!).

AMC Short Squeeze

So, how has Covid-19 changed the market? How can a pandemic change the way the market trades or behaves?

Well, during the pandemic it was reported that more than 10 million new brokerage accounts opened in 2020.

Let that sink in for a moment... 10 million more retail traders buying and selling shares in the open market. That was in 2020 alone. Another 10 million accounts were opened in 2021.

According to reports by the Wall Street Journal, the vast majority of those accounts are millennials with smaller amounts of money to trade or invest with, so here's how it can affect short term price action:

You have more people trying to invest or trade small amounts of shares all at the same time.

Small shares means less risk. Less risk means less emotions. Less emotions means you are trading against 10,000,000 people who don't care what the short term outcome of a stock is.

This can reek havoc amongst smaller time frame traders (particularly ones who were accustomed to "normal" market conditions with bursts of momentum every few weeks / months), and it was extremely rewarding (in the short term - more on this later) to new traders who didn't know any other market environment.

How Did More Participants Affect the Market?

The influx of new participants affected the market in a variety of ways.

One, for example, is that in normal market conditions, when a stock is extended (moved too far to the upside), it is typically met with a correction lower when emotional longs start to sell to take profits.

This wreaked havoc for the big short sellers who liked to short and average in to short side positions because it took a lot longer for exhaustion to happen in the stocks. These stocks would make absurd moves to the upside which would surge even higher due to the shorts covering out (squeezing).

It had a two pronged effect:

- Tons of longs piling into a stock at any price and getting rewarded.

- Tons of shorts trying to catch a top and getting squeezed.

If one person is long 10,000 shares of a stock at $20.00 per share, they have a sizeable position and if not properly managed with stop losses and a risk management strategy, the loss could be catastrophic for not properly managing the trade.

For example, if the stock dropped $1.00 per share, this trader would be down $10,000 unrealized.

But if 10,000 people are long 1 share each, they are only down $10 if the stock drops $1.00 per share, there's really no meaningful financial repercussion for not managing risk.

Its really just "fun bucks" at that level, and those "fun bucks" really moved the market for a long time! (Shout out to WSB "Wall Street Bets" and the "Ape Army").

The biggest moves that happen in any stock or asset is when a lot of people are on the wrong side of the trade.

For example, the recent short squeeze on VERU. This was a violent move that was mainly caused by many shorts being on the wrong side of the trade, which caused the price to rapidly increase as they fought for covers (or got liquidated by their brokers).

When an experienced trader is managing a large trade, they have predefined risk levels, stop losses, and take action when they have buy or sell signals that match their strategy.

Experienced traders know how to hunt those levels where people are going to make emotional decisions and trade against them.

The difference in 2020 and 2021 was that there weren't as many emotional decisions being made, and the obvious levels where people typically would sell were getting.. well.. bought up!

How the Pandemic Affected My Trading

As someone who has been trading for 15 years, I've seen it all. I began prop trading in March 2006. I've seen every cycle of momentum imaginable and day traded my way through the 2008 financial collapse and every other economic event since.

I've got over 15 years of screen time and experience, and I've designed my trading system to work in both bull and bear markets without adjustment.

I began my trading career as a scalper. I was very good at predicting short term moves based on price action, tape reading, and volume. This worked very well for me with the low fee prop firm fees, but the fact of the matter is that very few people are going to be able to make a full time living scalping stocks in the long term (some do, and I respect it, but it gets mentally exhausting), and the broker fees get heavy with a hundreds of executions per day.

I eventually changed to a more sustainable strategy that revolved around using larger time frames to plan for big picture moves in the market and using smaller time frame charts to time entries with better risk vs reward (which allows some scalping in between bigger moves).

It was more sustainable, more repeatable, less broker fees, less guesswork, more profits, and more importantly, less stress. It was my bread and butter for many years, and I rarely had to make any major tweaks to my strategy.

However, what we saw in 2020 was so bizarre and unprecedented that it left me thinking it was finally time to make some adjustments to my strategy.

Lucky for me, I don't take discretionary trades, I use back-tested repeatable chart setups that have stood the test of time to execute trades and define risk. So, I wasn't negatively affected by the market conditions in the sense that I was taking losses or getting caught in massive short term squeezes... I just wasn't getting as many quality trade setups as I was accustomed to.

Based on what I saw in a lot of stocks and charts, whether people want to admit it or not, discretionary short sellers got their asses handed to them during some of the rallys I was seeing on a day to day basis.

Hundreds of thousands of amateur traders chasing 100 share lots pushing the price up while experienced shorts averaged into positions until you eventually saw the blow off top where they all get stopped out. It was pretty wild to watch. I had never seen anything so remarkable last for so long.

These cycles of momentum are usually with less volume than we saw and last 3-6 weeks at most, and then things cool off a bit. This did not cool off for a long time.

My entire strategy revolved around low risk setups, not chasing momentum in hopes of quick reward. It was calculated and repeatable.

In other words, the system that I used for so many years was not giving me nearly as many quality signals as I normally would get due to the stocks always being too extended to one side (risk vs reward!), so I spent more time watching than participating while I was waiting for the cycle to burn out.

The short term fix was to start trading off larger time frame charts. I always paid attention to the bigger time frame charts and they are and always will be a big part of my trading strategy, but I started trading only off them for a while which worked great. It took out some of the extra noise and element of randomness that came from small time frames in the small cap space.

The way the market moved pn bigger time frames was the same as it always has been, and the exact same setups that I played on smaller time frames were still showing up on larger time frames, so I traded them... but I wanted to trade the smaller time frames as well to get better entries for the bigger picture moves.

In addition to that I started trading large caps during the slowest cycle of small cap momentum in early January. For the first time in many years they were actually more predictable than small caps that were generally traded by emotional retail traders who put stops at obvious levels which could be exploited by a more experienced trader.

I really enjoyed trading largecaps and will continue to trade them on big context days and during slower momentum cycles in the small cap space.

I was very stubborn. I didn't want to change the system that had been my bread and butter for so many years. After 8 months of thinking this boom phase in the market was going to bust any day (it didn't until January 2022), I finally made the necessary adjustments to my strategy to allow for smaller time frame signals (in areas of the charts that I never used to trade) to back up my big picture trade ideas.

The adjustment in where I took my initial entries resulted in lower risk, better entries, and more reward. As much as I fought to make the change initially, it just ended up just being a refined version of an already great trading strategy that just needed a tweak to get better results in the new market environment. That has continued to work for me even after the market momentum cooled down in 2022, so I don't plan to change it.

It appeared that algos and hedge funds were approaching the market differently about half way thru 2021 to present, buying into dips and selling into breakouts (and trapping shorts and longs who chased these moves - which was where most new traders made most of their profits in 2020/2021).

So breakout buying wasn't working as well, and the risk / reward was often not there for short setups due to the sharp declines in stocks without bounces and lower highs to define risk. So I had to adjust my strategy accordingly to be on the same side as the big boys who are now gobbling up retail traders by the dozen every day.

Now, enough about what the market was like during the Covid boom, lets talk about the more important topic of what it is now and how it could be affecting your trading in 2022.

How Todays Market Environment Could Be Affecting Your Trading

Lets talk about how the cooled off market environment could be affecting your trading in 2022. If you are one of the 20,000,000+ people who opened your first brokerage account in the past 2 years, there's a few things you need to understand:

1. The Momentum Has Shifted

The market that you traded the past two years was not a normal market environment. What you did those two years is likely not going to work today. Chasing momentum only works during the hottest market cycles and it is not sustainable in the long term.

The problem is, if you started in that market environment, and were rewarded heavily during that time, you are likely going to have a very hard time adapting to a bear market or a "normal" market environment where good trading habits are rewarded and bad trading habits are punished.

2. What Would be Considered “Bad Trading” is no Longer Being Rewarded

This is going to be a tough one for a lot of traders who entered the market during the boom cycle of 2021. What was working back then is not working anymore, but you don't know what else to do.

Your brains reward center has been tapped nonstop for 2 years and now and you've become accustomed to being rewarded for doing the wrong thing.

If you are feeling the pinch and starting to realize that trading is a lot harder now than it was the past couple years. The truth is, for most experienced traders, this market is easier than the previous market environment because it is more predictable.

If you continue to chase momentum in this bear market cycle, you are likely to give back everything that you made the past two years and more. So the time is now to stop banging your head against the wall with the same trades that are not working anymore, and develop a more savvy trading strategy with a big focus on repeatable setups, good entries, and proper risk management.

There shouldn't be any major highs and lows if you are trading properly with a defined system. It shouldn't feel like gambling either. It should feel like you are taking small calculated risks each day with the odds in your favor. No one trade defines your day, week, or month. You are looking at the big picture now.

3. We Have Been in a Bear Market Since January 2022

In the beginning of January 2022 we entered into a bear market. In the previous 2 years it was easy to make money as a day trader or swing trader if you simply bought dips or breakouts and managed risk properly. It was almost as if you could do no wrong at that time.

Those days of extreme bullish momentum, getting rewarded for chasing stocks, and being able to do no wrong are over. And we will likely never see an influx of volume like that again in our lifetime (particularly in the small cap space).

Sure, we will see bull market cycles and momentum again, but not to the level at which you get when 20,000,000 traders are all pushing the buy button at once.

4. You Have no Breadcrumbs

When starting trading from scratch in a normal market environment, it rewards good trading behavior and punishes bad. That's how it was when I started and it remained that way for most of my professional career.

When I made mistakes, I paid for them. When I traded poorly, I paid for it. It was a tough grind for a few years as I was learning the ropes and developing a strategy, but it instilled some really good trading and risk management principles that lasted me a lifetime.

There were special cycles of momentum where I could break trading rules and get paid for it. Chase a bit, loosen up a bit, and take advantage of some short bursts of momentum, but its a slippery slope coming back to normal trading.

Most of the time when people loosen up during momentum cycles, they end it with a big loss or two and then have trouble reverting back to their old strategy because they were so used to the quick reward pleasure center being activated in their brain, that they continue to lose more.

That's where bad habits develop and are very hard to overcome. Its my belief that most people need not adjust their system unless the market changes in such a big fashion for a long period of time (at least 3-4 months), and then start making small changes, but remember, you always need to be able to retrace your steps back to what has worked - thus leaving "bread crumbs" behind.

Using a trading journal is very beneficial for this reason.

If you have an old strategy, or one that worked before in normal market conditions, those are your "bread crumbs". You can always retrace your steps back to what worked before, unless you started trading in 2020/2021, in which case you may need to start over and build your bread crumbs from scratch.

3. You Don’t Have the Right Support Team

One of the astonishing things to me over the past 3 years was the amount of "experienced / professional" traders surfaced and began teaching trading to unsuspecting new traders.

Most of these people have a couple years on their twitter profile (which alone is an indication that they probably weren't trading before Covid), thus they don't have the long term experience a true veteran would have and are not prepared for bear market environments.

In the most favorable market conditions (last year) it was easy to trade. They probably seemed very smart and made a lot of good calls for you. But what's happening now? Chances are they are suddenly not doing as well. Most likely because they don't know how to trade a bear market because they have never been in one.

There are a lot of people out there trying to teach what they don't know. You have to be weary of these people as sometimes they even blatantly steal other peoples content and try to pass it off as their own.

Remember: Everyone is genius in a bull market.

I've seen a lot of popular trading names (who quickly became popular and mysteriously didn't exist pre-covid) disappear in the past 5 months because they know they cant trade in this environment.

As someone who's been in this business for such a long time, I can smell BS from a mile away, and there was a lot of BS floating around social media from people who clearly were not experienced at trading but had large personalities on social media that got a lot of attention. When the market dried up, they were gone.

Where Do You Go From Here?

If you are struggling with the topics mentioned above, you likely joined the stock market at the best (and the worst) time in terms of long term stability in your strategy. The first step is going to be accepting that what you did a couple years ago is not working now and begin working on a more sustainable long term strategy that will work in both bull and bear markets, as well as periods of slower momentum.

Learn how to properly manage risk, identify good buy and sell setups in the market (ideally using a systematic approach that has set criteria to enter and exit trades) and start back-testing your strategy until you have something that works in both bull and bear markets.

It sounds like a lot of work, and it is. I spend almost 5 years defining and refining my exact trading science through vigorous data gathering, back-testing, journaling, and failing until I finally got it right, and even then, I needed to make small tweaks along the way to make it better.

An experienced trader or team of traders can definitely help get you in the right direction. All you need is a solid foundation, and then you can tweak on your own to make the strategy fit your trading style and personality type, but you need that solid foundation that will be based off the same setups, signals, and risk management strategies that have stood the test of time.

If you need a starting line, you can begin with learning a solid risk management system that will help keep you in the game (if followed properly) once you've gotten your strategy refined to where you want it to be.

If you need any help, my door is always open. I respond to DM's on social media platforms and emails on the website. If you are really ready to leave 2020/2021 behind you and start fresh with something that's going to stand the test of time, our team would love to help out.

Either way, I hope this article helped you see what has changed in the past few years and give you some ideas on what you may need to do in order to make day trading, swing trading, or investing your career going forward.