Ever hear the expression "Time is Money"? By definition it means that time is a valuable resource (because our time in this world is limited), so it's better to do things as quickly as possible.

Ironically, this is the exact opposite of how you should approach your day trading. Let me explain.

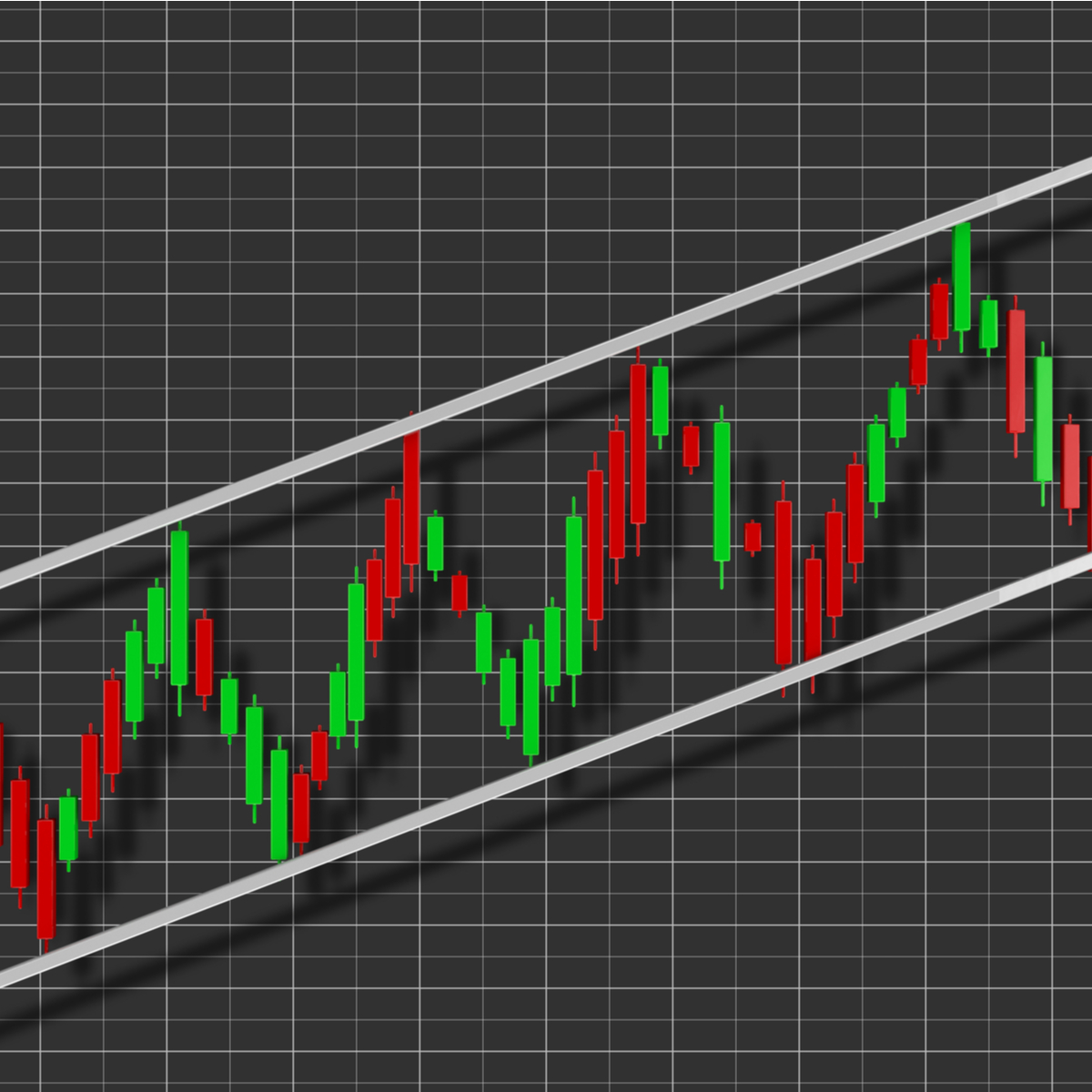

As day traders we are constantly seeking opportunities where we can take advantage of price fluctuations and inconsistencies in the market with a defined edge or strategy that allow us to profit with minimal risk.

Now, lets say that you have a particular niche, for example, shorting overextended/overvalued stocks, and you have a set of criteria that must line up for you to execute a trade based on your personal trading rules or system. When its "all systems go" and all the stars align for you to place that trade, you take the shot like a highly trained sniper.

Success in trading is achieved by great efforts

But what about when the stars aren't aligning? The market is choppy and you can't find any "trade setups" that meet your criteria. Or its a low volume day where breakouts aren't following through and nothing seems to be working. What if there are no junk stocks running for you to short today?

This is where people tend to fall victim of boredom trades, over-trading, and ultimately it leads to bad trades which can be damaging to your account and your ultimate goal as a day trader.

What people see on social media sites is the glamour that comes with trading. The lifestyle, the cars, the vacations, the travel - but they rarely see the dedication, persistence, resilience, and endless hours of hard work we spend developing ourselves to be the traders we want to be.

We are always working on ourselves as traders. Our mentality, our psychology, our systems, and we adjust them constantly as we adapt to the ever changing markets.

Patience and caution are key to success

Experienced traders have the ability to know when conditions are optimal, and when its best to protect our capital.

Think about it this way - we have the luxury as day traders to choose our own hours, vacation times, travel, and be our own bosses, so next time the market is choppy and you're thinking about placing that boredom trade - stop and find something else to keep you busy. Read a blog, Watch some video lessons, or go to the gym.

Ask yourself "Is this really a trade I want affecting my equity curve?" Do whatever you need to do to avoid the mistake of placing trades without a defined edge in your niche.

In Conclusion

Sometimes the best position is no position! As a day trader you need to be a master of risk and patience - even if that means sitting at your computer all day waiting for one opportunity that may or may not come, and when that opportunity does come, you'll be glad you waited.

Thanks for reading! Please a follow us and share this article if you enjoyed it!

P.S. - Grab our free webinar video on tips for account building and learn about our risk management and trading techniques!