What is the difference between adding or removing liquidity in the stock market, and what are the financial implications and benefits of each? This blog post should clear up any questions you have on the topic and let you know why its important to you as a day trader. Lets get started!

What is Liquidity?

First we have to define what liquidity is. Liquidity is a depiction of a financial product’s ability to be bought or sold easily at a price close to its current value.

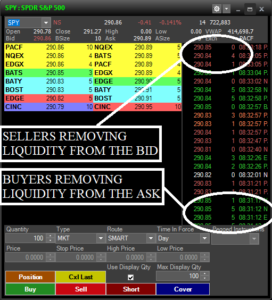

Lets make it even more simple: The bids on the left side of your level 2 and the offers on the right side are "liquidity" in the stock.

These are people who are bidding to buy or cover shares, and those who are looking to sell or short shares.

By having their orders in the open market they are adding liquidity to the market, letting other market participants (buyers and sellers) know they have shares available for purchase.

On the left are buyers who are bidding to buy the stock, and on the right are sellers offering to sell shares.

Removing Liquidity

Typically with new traders, their initial form of entry will be through a market order (visit our blog post on order types if you are unfamiliar with different orders you can place in the market).

Most brokerage platforms auto-fill your order entry boxes with a market order because it is the most basic and simplest form of order execution.

Using a market order will always remove liquidity from the market.

When executing a market order, you are either buying at the ask or selling at the bid and thus taking off shares from the current Level 2 book so that you can fill your order.

In other words, you are taking (or removing) shares off the order book from people who are offering them on the bid or ask.

In the example above, all of the time and sales prints (right side of the level 2) are transactions in the market that are removing liquidity from the market.

This is done by either executing a market order, or a marketable limit order to enter a position immediately (removing) as opposed to waiting on the bid or ask for a fill (adding).

The time and sales are the actual transactions happening in the stock.

Removing Liquidity with Limit Orders

All market orders are removing liquidity from the market as we have learned so far, however, a common misconception is that all limit orders are adding liquidity to the market.

This isn't entirely true. While limit orders do add liquidity to the market, if you are bidding to buy shares at or below the bid price, or offering to sell shares at the ask or above the ask price, you are adding liquidity.

There is also something called a marketable limit order which is the exact same as a regular limit order, except the price you are executing it is at the market price.

For example, if the bid of a stock is $3.00 and the ask is $3.01, if I send a limit order at $3.01, its going to immediately remove the liquidity from $3.01. My order will be executed and I'll be in the trade right away by removing liquidity from the sellers at $3.01 on the ask.

Adding Liquidity

On the other side of the coin, you have adding liquidity.

This is when one adds orders to the Level 2/order book and waits for someone removing liquidity from the market to take those shares.

For example, if I'm bidding as per the image below to buy shares at $290.74 or lower, I'm adding liquidity to the market.

If someone shorts or sells me those shares, they are removing my liquidity from the market. Their sell will show up on the time and sales as a red print.

Adding Liquidity with Limit Orders

The left side of the level 2 are buyers adding liquidity (bidding to buy shares) and the left side are sellers adding liquidity (to sell or short shares).

Hiding Liquidity (Hidden or Iceberg Orders)

Have you heard the term "iceberg" or "hidden order" before? This is simply the act of hiding your share size on the level 2 as to not reveal your share size to the public.

For example, if I wanted to sell 20,000 shares of stock at one price, I wouldn't want to show that huge order on the ask/offer price as it might scare potential buyers away.

Most brokers platforms allow you to hide your order size behind a smaller visible order on the level 2.

For example, with Trade Zero you can check this "Use Display Quantity" box at the bottom of the level 2, and set the Max Display Quantity to 100 shares.

Set the "display quantity" to the share size you want others to see on the level 2, regardless of the share size you are trading.

This means that even if I'm trying to sell 10,000 shares on the offer, its only going to show up on the level 2 as 100 shares. The order will "refresh" as 100 shares until the entire 10,000 is filled, or until I cancel or remove the order.

In other words, the 100 shares you're showing on the level 2 is only the tip of the "iceberg" as you have 9,900 more shares behind it to sell.

ECN Fees and Rebates

As we mentioned earlier, it costs more in trading fees to remove liquidity from the market than it does to add it.

In fact, there are ECN (Electronic Communication Network) rebates when you add liquidity through routing your trades to specific ECN's.

However, take note that ECN rebates are only available with a Direct Market Access brokers, and most brokers charge more in their per share commission structure than you would make from a liquidity credit, so you likely won't make money from simply adding liquidity.

Adding liquidity to the market still improves your bottom line when it comes to broker fees as you either get a free trade or an ECN rebate with most brokers.

Brokers like Trade Zero offer free commission whenever you do add liquidity (you pay no commissions or ECN fees), which is actually better than getting a rebate credit because as mentioned above, typically the ECN rebate you get from your broker for adding liquidity is less than what the broker itself charges for commission.

Different ECNs You Can Route Orders Through

Some of the exchanges you can route your order through include ARCA, NASDAQ, NYSE, EDGEX, and BATS. You can google each of these to find out the current fee schedule for each route. For example, here is the current fee schedule for using EDGEX.

Typically EDGEX and ARCA are the two ECN routes that offer the best (or any) liquidity rebate.

Adding liquidity takes the form of limit orders and has an incentive for traders willing to wait because they can get a rebate from the ECN.

Fees When Removing Liquidity

Something to keep in mind when you remove liquidity are ECN fees.

Every time you take liquidity from the market you are paying an additional fee on top of your commission for doing so (if you are using a direct market access broker with ECN routes like ARCA, EDGEX, BATS, etc to trade through). If you are using a broker that offers smart routes like Trade Zero, or any broker that charges a per trade fee instead of a per share fee, you don't have to worry about getting charged commission on top of the ECN removal fee.

Should I be Adding or Removing Liquidity?

Taking liquidity isn’t a “bad” thing. In many circumstances it is well warranted, and may be exactly what you have to do to get involved in a trade.

In fact, I almost ALWAYS remove liquidity to enter my trades and then add liquidity to exit my trades.

This makes sense because we time our trades at points where the market is going to move immediately in our favor, so at the time the market will move we are much less likely to have a seller fill us at the bid price just before entering to get long.

For example, we will use a limit order to remove liquidity from the ask/offer to enter the trade right away, and then add liquidity to exit the trade for profit by putting sell orders at or above the ask price to save money on fees.

There is no right or wrong when it comes to adding vs removing liquidity, only personal preference. However you execute your strategies will ultimately determine which of the two

you will likely be doing often.

With this blog we wanted to shed light on the general idea of removing and adding liquidity as well as a few little nuances. The main key takeaways are:

- Removing Liquidity: Taking shares off the bid and ask (I.e. Buying the offer, selling into

the bid)Removing liquidity comes with additional charges of ECN fees - Adding Liquidity: Putting orders out there on the Level 2 away from where the current

price and bid/offer are. (I.e. If the price is at $2.50, with the bid at 2.49 and ask at 2.50,

putting out sell orders at $2.55 and $2.75). - Adding liquidity (with Direct Market Access brokers) results in lower fees, ECN rebates, or even free trades.

I hope this post helps you understand this topic better, if you have any questions feel free to reach out to me anytime.

learn How To DayTrade Stocks

Get Started with a Free Day Trading Video Lesson Below!