About Ironbeam

In this article we will be reviewing Ironbeam, which is a futures brokerage firm that offers traders access to a variety of global futures markets and popular trading products such as E-mini and E-micro futures contracts ($ES and $MES). The company is based in Chicago, Illinois, USA and has been in business for over a decade, having been established in 2010.

Over the years, Ironbeam has become a well-respected name in the futures industry and has gained a reputation for providing excellent customer service and cutting-edge technology to its clients.

Additionally, Ironbeam offers a wide range of margin requirements and leverage options, which allows traders to customize their trading strategies according to their risk tolerance and market outlook.

Ironbeam Futures offers access to a wide variety of global futures exchanges, including CME Group, ICE Futures, Eurex, NYMEX, and COMEX. This allows traders to trade a variety of products, including futures contracts on commodities, currencies, and stock indices, among others.

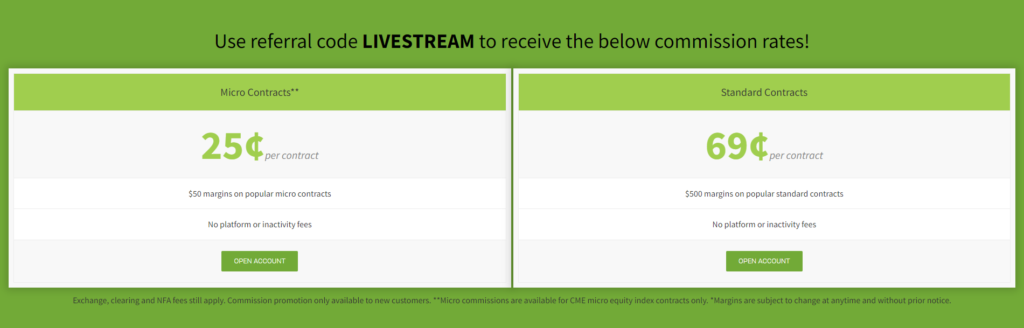

Ironbeam Pricing and Commission Structure

Ironbeam's pricing and commission structure varies depending on the type of account you open and the volume of trades you execute, however, we can get you a special discounted commission rate with Ironbeam, simply see the bottom of this blog post (or click the image below) to take advantage of the special offer!

Ironbeam Margin and Leverage

Ironbeam offers leverage margin to traders, which allows them to trade futures contracts with less capital than would be required if they traded with the full contract value. Here's how it works:

Leverage ratio: Ironbeam offers different leverage ratios for different futures contracts, which determines the amount of margin required to trade each contract.

For example, a leverage ratio of 10:1 means that a trader would only need to put up 10% of the full contract value as margin. This is why people with very small accounts can still trade a decent number of futures contracts at once and have the ability to accelerate their account faster than possible with stocks.

Margin requirements: Ironbeam's margin requirements are based on the exchange's margin rules, which take into account factors such as the contract's volatility and liquidity. Margin requirements may change depending on market conditions, and traders may be required to deposit additional margin to maintain their positions.

Initial margin: When a trader enters a futures trade, they are required to deposit an initial margin, which is a percentage of the full contract value. The initial margin is held by the broker as collateral to cover any losses that may occur if the trade moves against the trader.

Maintenance margin: If the trade starts to lose money, the trader may be required to deposit additional margin to maintain their position. This is known as the maintenance margin, and it is usually lower than the initial margin. If the trader fails to maintain the required margin, their position may be liquidated.

Leverage risks: Trading with leverage can increase the potential returns of a trade, but it also increases the potential losses. Traders should be aware of the risks associated with leverage trading and have a solid risk management strategy in place.

Overall, Ironbeam's leverage margin allows traders to trade futures contracts with less capital, but it also requires them to manage their positions carefully and maintain sufficient margin to avoid liquidation.

Ironbeam Trading Platforms

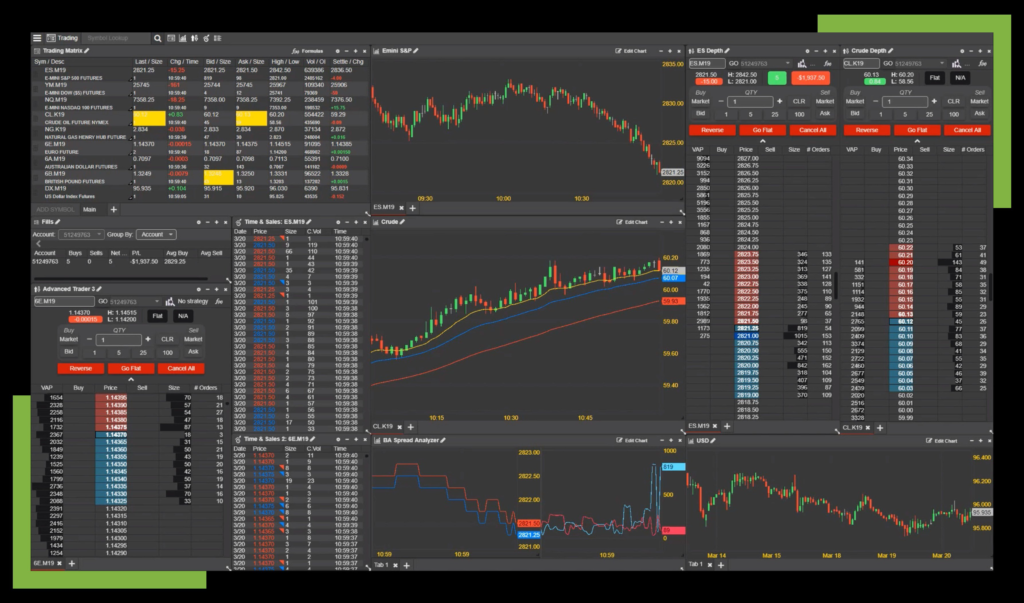

Ironbeam has its own trading platform which is great for the active trader, as well as many 3rd party trading platform options that you can elect to use as an alternative.

Their in house platform is designed to be user-friendly and intuitive. The platform is available in desktop, web, and mobile versions, making it accessible to traders on the go.

It features a variety of tools and features designed to help traders analyze market data, identify trading opportunities, and execute trades quickly and efficiently.

Ironbeam Trader is a downloadable trading platform that is available for Windows operating systems. It provides advanced charting tools, order management, and customizability.

The 3rd party platforms have different features, advantages, and disadvantages. In this article, we will take a closer look at the trading platforms that Ironbeam Futures offers and highlight the pros and cons of each.

Ironbeam Trader Pros:

Advanced charting tools: Ironbeam Trader has a variety of technical indicators and charting tools that traders can use to analyze the market.

Customizability: Traders can customize their trading workspace to suit their needs, such as by adding or removing windows or changing the color scheme.

Speed of Execution: Ironbeam Trader is fast and reliable, which is important for active traders who need to execute trades quickly.

A big pro of Ironbeam is that you are opening an account directly with a CME Group clearing member firm and FCM. There are over 1,000 introducing brokers out there, only 63 FCM’s, and only 25 CME Group clearing member FCMs. Ironbeam is in a unique position with allowing customers to open accounts directly, and get a free trading platform that has direct to CME routing & data and versions for every device and operating system.

Ironbeam Trader cons:

Limited Functionality: The in house platform does not have click and drag to move orders and manage positions in the chart window, however, they are adding this soon. Many of the 3rd party platform options you can choose when trading with Ironbeam does include this feature.

Charting: The charts, while nice, aren't quite as robust as a platform like Trading View (which is also an option to connect to Ironbeam).

Ironbeam Web Trader

WebTrader is a browser-based trading platform that can be accessed from any computer with an internet connection. It provides basic charting tools and order management. Some pros of WebTrader include:

Accessibility: Traders can access WebTrader from any computer with an internet connection, which is convenient for traders who travel frequently or use multiple computers.

User-friendly interface: WebTrader has a simple and intuitive interface that is easy to navigate, even for traders who are new to futures trading.

No downloads required: Since WebTrader is browser-based, there is no need to download any software or updates.

Keep in mind that WebTrader is not as advanced as Ironbeam Trader and does not have as many charting tools or customization options.

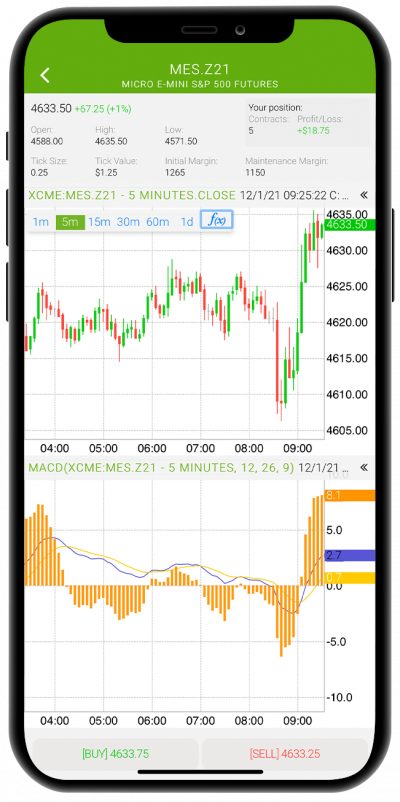

Ironbeam MobileTrader:

MobileTrader is a mobile app that is available for iOS and Android devices. It provides fully customizable charting tools and order management. Some pros include:

Portability: Traders can access MobileTrader from their smartphone or tablet, which is convenient for traders who are on-the-go.

User-friendly interface: MobileTrader has a simple and intuitive interface that is easy to navigate.

Push notifications: Traders can receive push notifications on their mobile device for order fills, price alerts, and news updates.

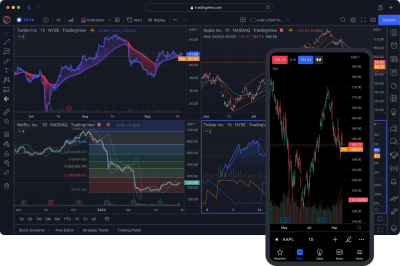

TradingView and Ironbeam

TradingView is a web-based charting platform (with a desktop app) that offers users advanced charting, analysis tools, and real-time market data. The platform is popular among traders due to its user-friendly interface and ability to customize charting features. Ironbeam Futures offers its clients access to TradingView with a funded account.

Pros:

- TradingView is easy to use, even for beginner traders.

- The platform offers a wide range of charting features and technical analysis tools.

- TradingView provides real-time market data.

Cons:

- TradingView does not offer a direct connection to the exchange, which can result in slower execution times. I've personally tried Trading View with Ironbeam, and while it has some great features, execution is slower at times.

- You cant execute orders on the Trading View mobile app with Ironbeam. If you plan to trade on mobile a lot, I recommend using their in-house platform with mobile trader.

- You cant automate your trading strategy with Trading View. You can, however, use pine script to write code that can backtest your strategy and give you alerts when your strategy gets a signal.

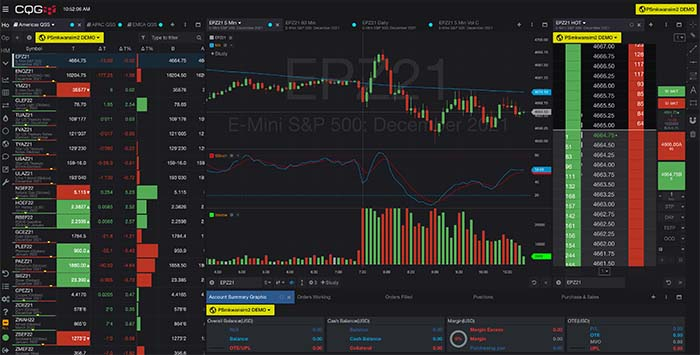

Ironbeam with CQG Desktop Platform

CQG Desktop is a trading platform that provides advanced charting, technical analysis, and order execution capabilities for futures and options traders. When used with Ironbeam Broker, CQG Desktop offers several benefits that can help traders make better-informed decisions and execute trades more efficiently. Here are some of the key benefits of using CQG Desktop with Ironbeam Broker:

Advanced charting and technical analysis: CQG Desktop offers advanced charting capabilities that allow traders to analyze price movements and identify trends using a variety of technical indicators and drawing tools. Traders can also use CQG's proprietary TFlow® tool to track order flow and identify potential market reversals. These tools can help traders make better-informed decisions and identify trading opportunities more quickly.

Customizable interface: CQG Desktop's interface is highly customizable, allowing traders to tailor the platform to their specific needs and trading style. Traders can create custom watchlists, alerts, and order templates to streamline their workflow and improve efficiency.

Order execution and management: CQG Desktop provides a robust order management system that allows traders to place, modify, and cancel orders quickly and easily. Traders can also use CQG's advanced order types, such as bracket orders and trailing stops, to manage risk and optimize trade entries and exits.

Market data and news: CQG Desktop provides real-time market data and news from a variety of sources, including exchanges, news wires, and social media. Traders can customize their news feeds and use the platform's alert system to stay informed about market developments that may affect their trades.

Integration with Ironbeam Broker: CQG Desktop is fully integrated with Ironbeam Broker, allowing traders to execute trades and manage their accounts directly from the platform. Traders can also access Ironbeam's commission rates and other account information from within CQG Desktop.

Does CQG Offer Automated Trading?

CQG provides support for automated trading through its API (Application Programming Interface), which allows traders to create custom trading strategies and automate their trades.

CQG's API provides a range of features for automated trading, including:

Order execution: Traders can use CQG's API to place orders and manage their positions automatically based on predefined trading rules and strategies.

Market data: CQG's API provides real-time market data for futures, options, and equities markets, which can be used to develop trading algorithms and strategies.

Historical data: Traders can use CQG's API to access historical market data, which can be used to backtest and optimize trading strategies.

Technical analysis: CQG's API provides a range of technical analysis tools and indicators, which can be used to develop trading strategies and signals.

Risk management: CQG's API provides tools for managing risk, including position monitoring and margin calculations.

Compatibility: CQG's API is compatible with a range of programming languages, including C++, Java, and .NET, which makes it accessible to traders with different programming backgrounds.

Overall, CQG's API provides a powerful set of tools for automated trading, which can be used to create custom trading strategies and automate trades in futures, options, and equities markets.

Sierra Chart and Ironbeam

Sierra Chart is a customizable trading platform that provides advanced charting, technical analysis, and order execution capabilities for futures and options traders. It is known for its fast and reliable order execution and its support for advanced order types.

This is a more advanced platform for more advanced traders.

Sierra Chat Features

Customizable charts: Sierra Chart provides highly customizable charts that allow traders to display multiple chart types and technical indicators on a single chart. Traders can create custom chart templates and save them for future use.

Advanced technical analysis: Sierra Chart provides a wide range of technical analysis tools, including over 300 built-in technical indicators, custom indicators, and drawing tools. Traders can use these tools to analyze price movements and identify trends and trading opportunities.

Market data and news: Sierra Chart provides real-time market data and news from a variety of sources, including exchanges, news wires, and social media. Traders can customize their news feeds and use the platform's alert system to stay informed about market developments that may affect their trades.

Advanced order types: Sierra Chart provides advanced order types such as bracket orders, trailing stops, and OCO (One-Cancels-the-Other) orders. Traders can use these order types to manage risk and optimize trade entries and exits.

Automated trading: Sierra Chart provides a built-in scripting language called ACSIL (Advanced Custom Study Interface and Language) that allows traders to create custom indicators, trading strategies, and automated trading systems. Traders can also use third-party trading systems and order routing services that are compatible with Sierra Chart.

Market depth and time and sales: Sierra Chart provides real-time market depth and time and sales data for futures and options markets. Traders can use this data to analyze order flow and identify potential market reversals.

Trade simulation: Sierra Chart provides a built-in trade simulation feature that allows traders to practice their trading strategies and test new ideas without risking real money.

Sierra Trader Overview

Overall, Sierra Chart is a powerful trading platform that provides advanced charting, technical analysis, and order execution capabilities for futures and options traders. Its highly customizable interface and support for automated trading make it a popular choice among professional traders.

While Sierra Chart is one of the best platforms we have tested, we are sad to report at this time it does not have a mobile app, which could be a deal breaker for many people who trade away from their home screens.

Ironbeam Summary

In conclusion Ironbeam is a futures broker that offers a range of trading platforms, including CQG Desktop, CQG Integrated Client, Sierra Chart, Rithmic, Trading Technologies (TT), MultiCharts, and more.

The broker provides access to futures and options markets around the world, including agricultural, energy, metals, currencies, and stock index futures.

Ironbeam offers competitive pricing and low commissions (check out discount below!), as well as access to advanced trading tools and features such as real-time market data, advanced charting, technical analysis, and automated trading.

The broker also provides excellent customer support and education resources for traders of all levels, making it a popular choice among futures traders.

Remember, like with any type of trading, futures comes with a high degree of risk. Be sure to get educated on how to trade effectively with a backtested trading strategy and risk management system.

Get a Discount with Ironbeam

As a friend of Livestream Trading, you are automatically eligible for a discount with Ironbeam futures. Simply click here to register for an account and use coupon code: LIVESTREAM to receive our special commission rate.

We get up to 50% off the normal price (as low as 0.25 cents per micro contracts and as low as $0.69 cents per contract for mini's! All you need to do is use the coupon code: LIVESTREAM at registration to get the discounts applied.