Hello traders, in this blog post I want to go over some ideas on how you can improve the bottom line of your day trading by treating it more like running a business rather than "winging it" which is what leads a high percentage of new traders to failure.

Too many new traders try to approach trading stocks as an easy task: buy low and sell high, right? Wrong!

Day Trading is a serious business and a skill that takes time to develop.

Its like developing a muscle, you start small and build over time with slow and steady gains.

Lets compare it to weight lifting: you might start by bench pressing 120lbs but it could take months before you are ready to bench 150lbs.

If you go straight for those heavy weights (or gains) without the proper training, you are likely to injure yourself, and as a result, you may not be able to lift (or trade) anymore.

Here's how you can start treating your trading more like a business today.

Create a Trading System

If you are taking trading seriously, then you need a strategy and system that tells you when to "pull the trigger" and take a trade.

With an objective approach to trading, and a simplified trading strategy, you can learn exactly when it makes sense to take a trade and be confident that the reward far outweighs the risk.

Our system revolves around timing the trade to be in the before the herd, thus minimizing your risk exposure and maximizing your reward on the trade.

You can develop your own system through back-testing and aggregating data from your own trades, which will take time (and cost money if you are doing it with a live account - so we recommend using a demo account for aggregating data) or you can replicate and tweak an existing system to suit your trading style.

When you are trading a system with a very specific set of criteria, it can help eliminate guess work and boredom trading - If there is no trigger, then there is no trade!

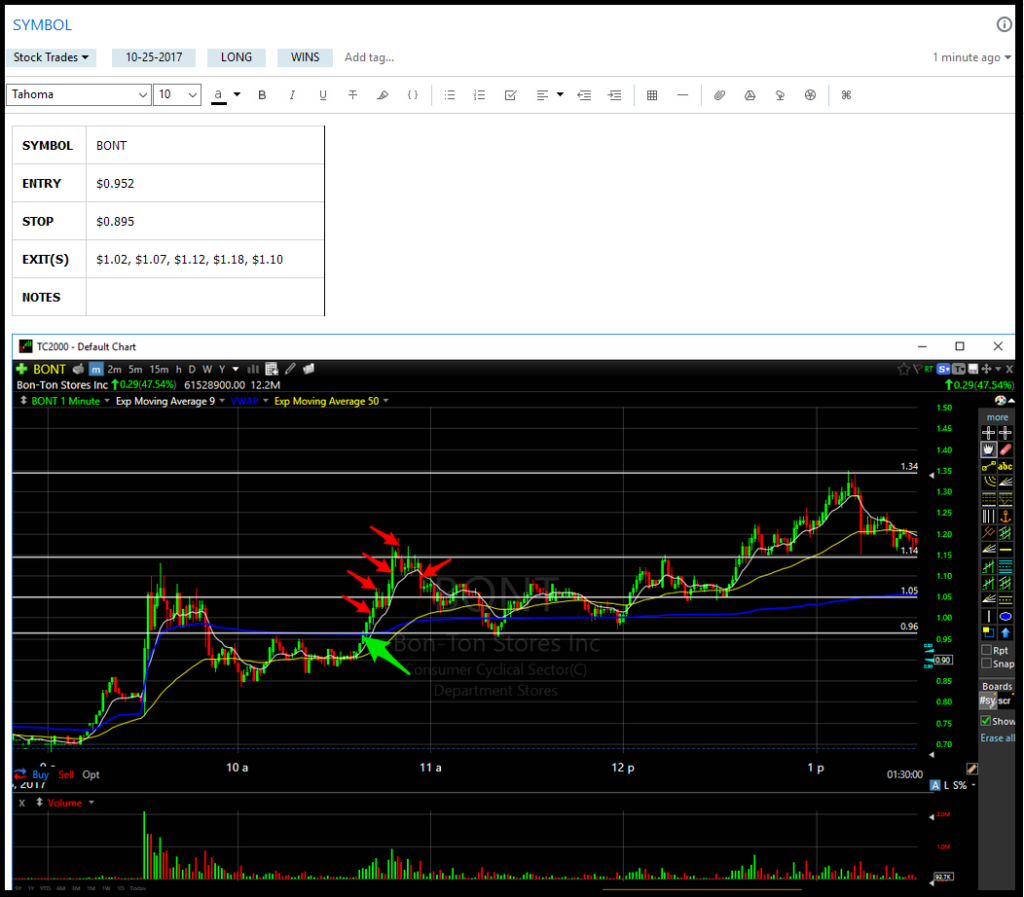

Live Trade on $BONT from 10-25-2017 via LiveStream Trading

Manage your money wisely

Capital preservation is key in this business - too many traders feel like they have to be in every stock that is moving; this will lead to over-trading and may hurt your bottom line.

Less is more in this business. Over-trading can be detrimental to your trading business, so pick your spots carefully and stop trying to be in every trade, and just be in the trades that offer the best reward vs your risk, so you can start padding your account with gains.

Start small and analyze your data

The way I teach my trading students to grow their accounts is through steady gains over weeks and months, tracking the results every step of the way, analyzing the data, and making adjustments where necessary.

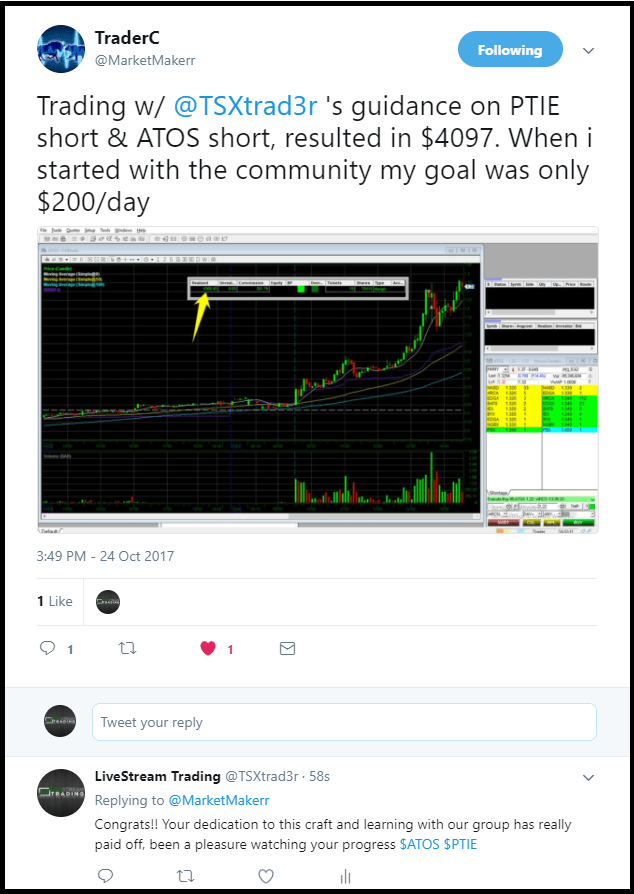

We've seen great success from students who follow this approach of starting small and realizing small gains per day and per week through consistently following our trading rules, setups, and risk management strategies. The hardest part is being patient in between the trading opportunities and not forcing trades on slow market days.

Notah Trading Results

Work on your day trading and investment skills

First, I usually have to start by unteaching them all the bad habits they've picked up from other trading rooms such as chasing low float stocks, over-trading, buying with the herd, and adding to losing positions, and get them to focus on a few key repeatable trade patterns that work consistently with low risk setups, and then we work on improving their entries, exits, and risk management techniques.

In order to keep proper track of your trading, a journal or program like Evernote or TraderVue is essential. I personally keep an Evernote journal with screen shots of all my trades so I can quickly get an overview of where I entered and exited the trade, and make notes of where I can improve.

Its important to analyze the data in your journal to see which trades you are winning/ losing on, and look for patterns in your trading behavior that you can tweak to become more consistent.

Improve your bottom line

I often find with our trading students that one or two types of trades are hurting their bottom line, so we either look to correct the entry and exit points on those trades, or stop taking them all together and focus more on whats working for the student.

There may be one type of trade that you take that is hurting your bottom line, and sometimes the best solution is to identify it through utilization of a trading journal, and then remove that trade setup from your arsenal.

It all comes back to analyzing the data and removing the problem trades, the same way that a business owner would analyze their inventory and stop selling a product that is sitting on the shelf collecting dust.

Focus on the process - not the money

The gurus in this business who flash money, cars, vacation homes, and other assets are ironically counterproductive to so many new traders success; it totally takes your focus off the process of learning to trade like a professional, and makes it all about money and tangible things. This is like poison to the new day traders mind.

First, you should focus first on learning to trade properly with small size (or with a simulator) and track the results. Stop thinking about the money and just focus on the process of trading well.

Our risk management strategies and entry/exit triggers are a great start. Most new traders don't know the trigger points in where to buy and sell stocks to achieve a good risk vs reward ratio and a high probability of the setup playing out in their favor.

Once you have shown yourself through data and experience that your process is working well, you can slowly start to build your position sizes bigger. Check out our video on bankroll management which is key for not letting one trade or one bad day set you back weeks or months in your trading.

Learn from an experienced trader

Its amazing how many people are willing to lose $5000 in trial an error rather than spend $79 to learn from someone who has years of experience in this business and is willing to teach you everything you need to know; and allow you to follow live trades for educational purposes. I can’t stress this enough: find a mentor.

Warning: If your mentor uses terms like "Millionaire" "Profit" "DVD" and "Lambo" more than terms such as "Risk Management" and "Analyzing Data" - Run away fast. Furthermore, if the word "Profit" shows up in the website URL - run faster. Furthermore, be aware of Pump and Dump Groups!

It took me years of expensive trial and error from 2006 - 2009 before I came up with anything that started to work. It was brutal. I wish I had access to the resources available for traders today, even our YouTube channel can get you on the right track in a lot of areas, including risk management and some trading strategies.

Check out our trading group

Our trading group members get over 500+ video lessons, webinars, and trade recaps for free as a student of our trading group, as well as a free course that outlines my risk management system.

They get to watch over my shoulder as I trade live during the day on every trade from entry to exit - this is the biggest learning experience of all.

There is no better or faster training you can get than that, and believe me, you won't get anything close to that experience from any course or DVDs.

I have students who in a few short months are at levels that took me over 5 years to achieve. They skipped all the trial and error, they learned how to manage risk, trade setups, and be disciplined in their approach through my mentoring, and as a result, shaved years off their learning curve - its truly inspirational and I hope to see more dedicated traders take the time to learn this business properly, and be part of a serious trading team.

The conclusion

Stock trading is not an easy business. But there is no business out there that doesn't come with its challenges, however, if you are serious about learning to trade properly, become a master of risk management, and start small to build a better future for yourself, we would love to work with you in our trading group.

Until next time, trade safe and trade smart!

Learn How To DayTrade Stocks with LIVE trades, daily training webinars, and our FREE systematic trading course for members.

Get our free Video Lesson on how to trade our favorite breakout pattern!