In this comprehensive review of Trade Zero we will cover everything you need to know about this broker so you can make an informed decision as to whether they are a good fit for you, and give some ideas on how to navigate around some of the potential drawn-downs.

What is Trade Zero?

Trade Zero is an online brokerage firm for US and international traders. They offer a competitive free (zero commission) trade structure with no PDT (pattern day trader rule) restrictions for international and Canadian clients, and up to 6:1 leverage for US clients.

What Services Do They Offer?

Trade Zero offers stock, options, and as of 2023 they have introduced cryptocurrency trading with their platform. They currently do not offer E-mini futures trading. We're hoping to see an addition of futures trading with Trade Zero in the future.

Minimum Deposits and Account Leverage

Below is the breakdown on the minimum deposits and leverage (margin) allowed. Please note you don't have to use margin, but for experienced traders with good risk management principles, margin trading is a great tool to allow you the buying power to trade multiple positions at once with a smaller account size.

Note: The minimum deposit $500 for a cash account. Cash accounts can not trade on margin.

Trade Zero Margin Account Leverage:

Accounts under $500 - Cash account with no leverage.

Accounts under $500 - $2499 – Gives traders 4:1 leverage

Accounts over $2500 – Gives traders 6:1 leverage

Trade Zero USA vs Trade Zero International

Trade Zero has a different fee structure for clients based in the USA vs International clients.

Trade Zero USA clients have the benefit of 100% free (zero commission) trades whether adding or removing liquidity from the market.

International clients get free trades for adding liquidity but pay $0.005 per share for removing liquidity.

Trade Zero Trading and Platform Fees

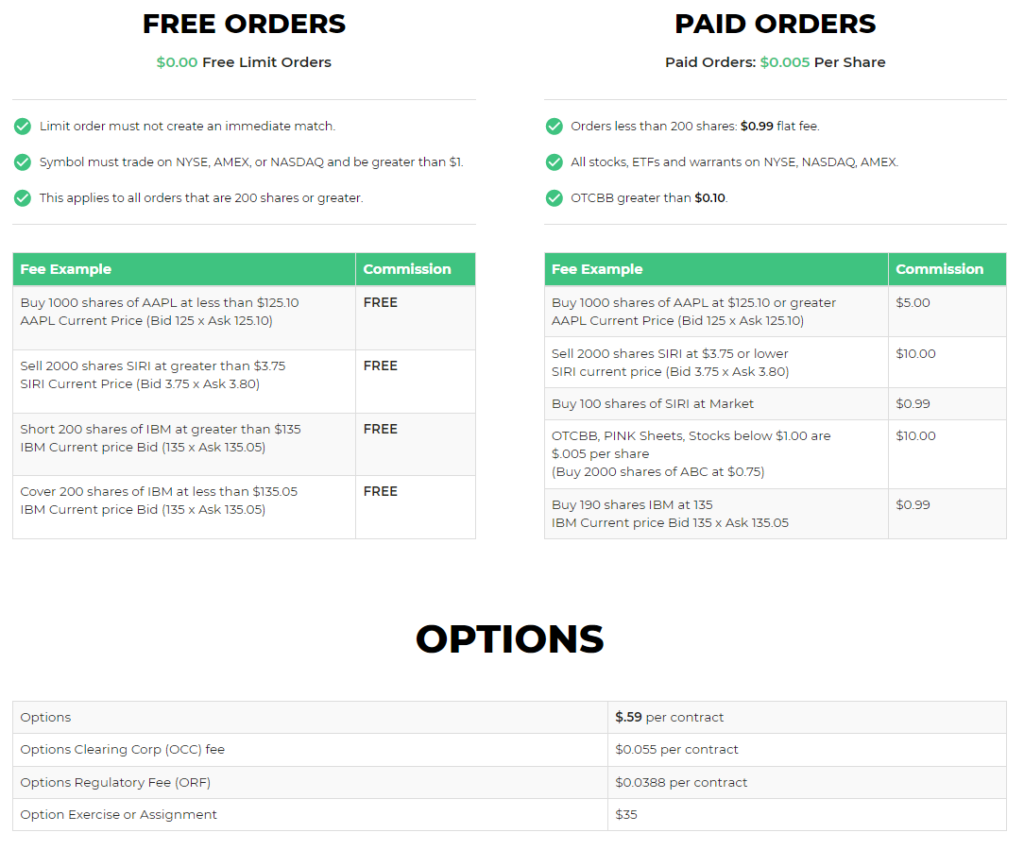

Below is the breakdown on Trade Zeros pricing model for international (outside of the USA) clients:

Limit Order Trades:

FREE (adding liquidity to the market)

Market Order Trades:

$0.005 per share (removing liquidity from the market)

Zero Pro Platform:

$79.00 Per Month with data and level 2 (This fee is waived if you trade more than 100,000 shares per month)

Zero Web Platform:

$59.00 Per Month with data and level 2 (This fee is waived if you trade more than 80,000 shares per month)

Zero Mobile:

free if you have an active Zero Web or Zero Pro platform.

Trading Options with Trade Zero

Trade Zero does offer options trading with their platform, however, options trading is not commission free, they do charge $0.59 per contract. While you can solely trade options with Trade Zero, it may not be the go-to broker for someone who only trades options, as I feel this broker is better suited for stock traders and particularly small cap traders.

Trade Zero’s “Zero Hash” Cryptocurrency Trading

Crypto trading has landed! As of the year 2023 Trade Zero now offers cryptocurrency trading via their Bahamas branch. They give access to about 20 coins including popular ones such as Bitcoin and Ethereum.

Opening a Cryptocurrency Account with Trade Zero

In order to open a crypto account with Trade Zero you must have a current stock trading account with them and apply for a cryptocurrency account via the account dashboard on their website. The account is required to be funded with at least $500USD.

Simply click on "My Account" and select the "Enable Crypto" option to get started with the process. You fill out a quick application and upon approval, you will have access to the crypto trading platform. \

Cryptocurrency Trading Rules

There are a few things that may differ from some other exchanges when it comes to trading crypto with Trade Zero. For example, you can not transfer coins in and out of the crypto account. You can buy and sell coins with the cash in your account, and when you wish to withdraw your money, you can do so anytime, but you cant transfer coins to other exchanges.

There is also no margin trading or short selling with digital currencies with Trade Zero. While these points could be a deal breaker for some, Trade Zero is a very well established company with trust in the stock trading industry so it seems like a safer option than some of the fly-by-night exchanges out there, but please do your own due diligence.

Trade Zero VS RobinHood

There are other brokers that offer free trades with zero commission, but in our opinion they are inferior to Trade Zero in regards to customer service, professionalism, and most importantly, a professional platform.

Many of the more basic brokers don't offer advanced charting or platforms. Many of them don't offer the ability to trade in pre-market and after hours which is essential. If, for example, a stock releases news after the market close and you can't exit your position, that can be a disaster. Trade Zero has great extended trading hours so you can always enter or exit a position in pre or post market.

Also, Trade Zero gives you the option to short hard to borrow small cap stocks, and has a more advanced trading platform, so there is really no comparison here, Trade Zero is hands down the better broker between the two.

How is it Possible for Trade Zero to Offer Free Trades?

Trade Zero routes their limit orders through EDGX, ARCA, and other ECNs which provide a liquidity rebate, so when you place a free limit order trade they route it through EDGX (or another rebate route) allowing them to collect the liquidity rebate and pass the trade on to you for free.

How is Trade Zero’s Execution?

Trade Zero does not internalize orders, and they are required to provide clients with the best execution price available at all times. When I add or remove liquidity from the market, there is no delay in execution, the orders execute immediately.

As TradeZero offers US market access and clears through a US clearing firm, Trade Zero is subject to Reg NMS. This basically states that firms are obligated to provide investors with executions at the best possible price.

Short Selling and Borrows on HTB (Hard to Borrow) Stocks

For shorting hard to borrow (HTB) stocks, Trade Zero is one of the best in the business. You can find locates on virtually any HTB stock directly from their platform. I've found that often when all other brokers are bone dry for shares to borrow on HTB stocks, Trade Zero has them available.

As a Canadian based day trader who loves to short sell overvalued NASDAQ stocks, I've struggled in the past to get the locates I've needed on hard to borrow (HTB) stocks until I started trading with Trade Zero.

Many of the popular brokerage firms who are clearing through Wedbush do not offer their service to Canadian clients, so Trade Zero was a huge breakthrough for me in terms of short selling HTB symbols. This is one of the reasons why I opened an account with them; for locating HTB stocks they are truly exceptional.

Shorting Stocks with Trade Zero

They have shorts on virtually any hard to borrow stock you can imagine, and of course, you do have a pay a premium to locate these shares (as you would with any other broker). The cost of borrows vary depending on the demand for borrows on the stock, but on average it is around $0.023 per share for the locate on a HTB stock if you want to short it.

I would argue that Trade Zero is one of the best brokers for those who like to short small cap stocks as they have the most availability for borrows compared to other brokers we have tested.

How do I Return Borrowed Shares for Credit?

Returning borrowed shares is a feature that Trade Zero added to their platform last year. Ive never heard of another broker doing this before, so it is a unique and neat feature.

Once the shares have been borrowed, scroll to the ‘Short List’ window and click on the ‘Inventory’ Tab. This will display the borrowed shares of stock you have and to the right of that you will see a quantity box and ‘Credit’ button. Just input the amount of shares you’d like to sell back and click ‘Credit’. Your shares will then be placed in a queue of available shares for other customers to purchase from on a first come, first serve basis. If someone buys your borrows, you get the money credited back to your account.

What platforms does Trade Zero Offer?

Trade Zero offers three platform options. Zero Pro which is their desktop software ($79 per month with data for international clients, and only $59 per month for US based clients), and Zero FREE which is their free web based platform, and Zero Mobile which is their free mobile platform.

Trading Software

The software I've used with my previous brokers are DAS Pro, Sterling Trader Pro, and a proprietary trading software I used in my early trading days with the prop firm I started trading with in 2006.

Zero Pro is Trade Zero's platform, which is a white labelled and improved version of Turbo-Tick Pro, which is a professional trading platform. Trade Zero's version has added functionality specific to Trade Zero, for example, the improved hot keys - which makes it quite a bit better in my opinion.

The platform has access to thousands of trading indicators and charting tools, options chains, a scanner for seeing top volume and top percentage gaining stocks, and much more.

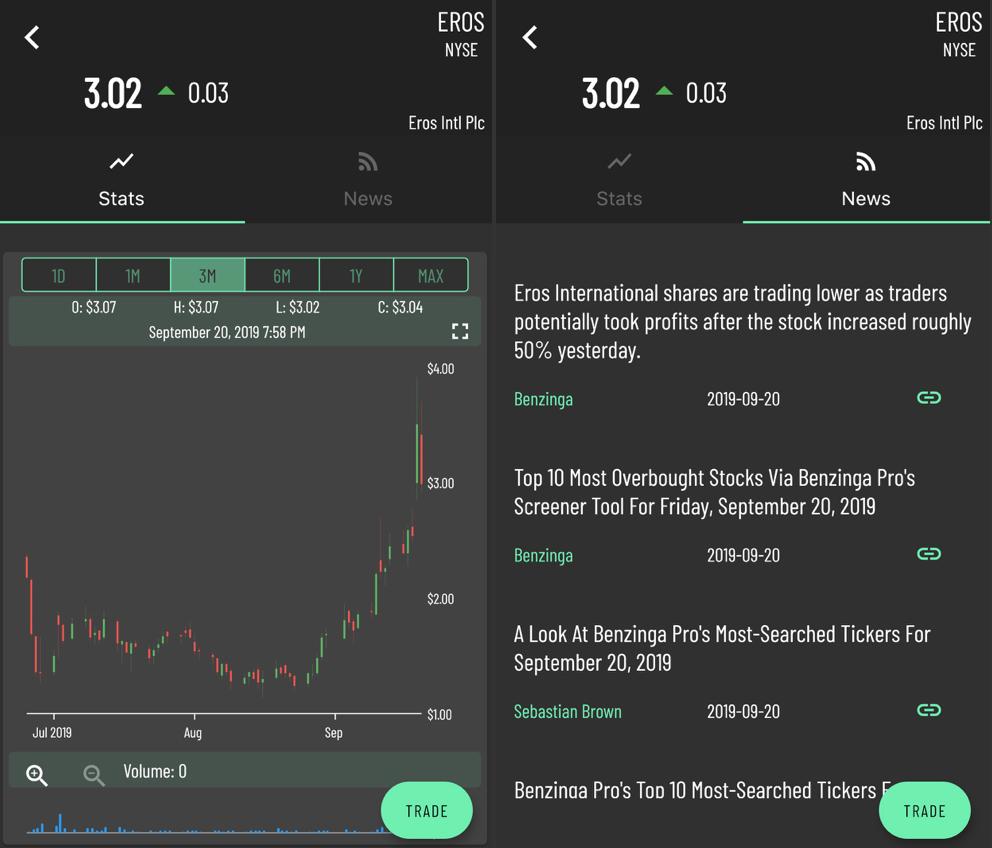

Mobile App

For traders who cannot be at their trading desk for the whole session or have to abruptly leave in the middle of a trade, the mobile app meets all your needs. With revised charts, and watch-list configurations, in addition to the ability to grab locates on your phone, Trade Zero offers an excellent way for traders who require location flexibility to put on and manage trades.

New Mobile App Features:

Some great features you can find directly on their mobile app is the ability to pull up fundamental data on stocks such as their Market Cap, Average Volume, 52-Week High, etc. Also, you can find news relevant to any stock you are trading or looking to trade. The Mobile app isn’t as detailed or loaded as the Zero PRO software but it fully equips mobile traders with everything they’d need from locates, to charting, to trade management and fundamental data.

Mobile App Screenshot. New Charts, Ability to Locate Borrows/Shorts via the Platform. Built in News feed, Watch-Lists, and more!

Trade Zero charts

I like the platform just fine for executing orders, tape reading, watching the level 2, and managing positions. I do spend a lot of time reading charts and explaining setups with visuals on my live screen share, and I found the platforms charting to be lacking at first, but they have made some recent upgrades that make the charting experience much more efficient.

Trade Zero Chart

While some people may prefer to use Trade Zero with a 3rd party trading platform such as TC2000 or Trading View, the charting included with Trade Zeros platform is adequate and good enough for most users.

Platform and Software Updates

Trade Zero has recently hired a superstar developer who has made some major positive changes to the platform and charting and they are continuing to roll out updates every couple weeks with new and improved features. The latest software is very good, and the charts are much improved and they are always listening to users opinions and adding new features.

Zero Pro Hot Keys

You may have read my blog post on hot keys and how important they are to me as a trader. At first, their hot keys weren't great and I was finding myself trying to point and click orders instead, which was difficult on some of the faster moving more volatile names that I trade.

As traders we are creatures of habit, and after spending so many years using one hot key setup, its very difficult to change.

I sent them some feedback, and less than one month later they made a huge update to their hot key setup so that they function EXACTLY the same as Sterling Trader Pro and DAS Pro - I couldn't be happier with this change. I'm able to send and cancel orders with the press of one button and have full control with my keyboard for order entry and execution.

For those of you who are curious about my hot key setup with Trade Zero, here's a video I did explaining how to set up hot keys with their platform.

Trade Zero Application Process

Trade Zero's application process is the easiest and fastest I have ever done. I had my account setup inside of 15 minutes. You can sign up for an account and trade with a free demo account for a week to see if you like it.

Keep in mind the executions on a demo account do NOT reflect on the way the live accounts execute. The live account execution is perfect.

If you do, you can go ahead and fund the account, if not you can play with the demo which includes free real time data for 7 days.

Here's a quick tip to speed up the application process:

When asked for the standard documents which are required to open any brokerage account, such as photo ID, passports, and/or utility bills, simply take a good clear picture of the documents with your cell phone and email it to yourself. Download the attachment from your email to your computer as an image file and upload it to the application as requested.

Trade Zero 24/7 Customer Support

Their support is fantastic. They have a live 24/7 chat widget right on the website and anytime I've needed assistance, there is an immediate response. If phone assistance is required, you can call Trade Zero's US or Bahamas branch during normal business hours.

Trade Zero and LiveStream Trading

At LiveStream Trading we are always looking for new ways to help our group traders get a better edge in the market, and Trade Zero has really given our new traders the opportunity to learn and grow an account without having to deal with huge commissions that can nickel and dime a traders account.

I never recommend a product or service that I would not use myself, and I can proudly say that I am actively trading with this broker and saving a TON of money on commissions with our group traders.

When I am shorting a hard to borrow stock, I am happy to know that all of our group traders who are using Trade Zero can participate in the trade giving everyone an equal opportunity to profit.

As a member of LiveStream Trading, or a follower of our blog, I would like to extend to you a special offer we have worked out with Trade Zero.

How do I Get a Discount with Trade Zero?

All you need to do is open your account and you can enjoy some huge benefits including better leverage/margin, cheaper platform fees, and more.

All of the benefits are listed on this page and you will have them automatically applied to your new account.

In conclusion, I would recommend this broker to any trader who wants to save on commissions and have access to short hard to borrow stocks.

In Conclusion

Trade Zero is one of the leading retail brokers on the scene and I am proud to say I have been a client of theirs for over 6 years now. Their top of the line software, customer service, locates, executions, commissions and rates for software and data are among the best out there. Furthermore, with the back-end team they’ve put together, they are continuously pumping out new, innovative features and updates to meet any and all customer feedback.

Remember, having the right tools for the job is very important, but the most important aspect of trading is having a back-tested and proper trading system that can produce the results you want as a trader. Please check out this blog post to learn more about developing a profitable trading system and until next time, trade safe and trade smart!